Current dynamics

Today in the afternoon AUD/USD is recovering after the losses during the opening Asian session. Weak macroeconomic reports from China were the reason for the decline of the trading instrument. Traditionally Pacific Rim currencies are extremely sensitive to the conditions of the Chinese economy. The main factor influencing the AUD is the iron ore prices, which Australia supplies to Chinese industry. In addition, a slowdown in Chinese economic activity has a negative impact on the global economy and weakens investor interest in currencies with high beta coefficients.At the same time, China is under enormous pressure due to the new outbreak of Covid-19. Investments, the majority of which are in the Chinese industrial sector, have fallen by up to 6.8% . Industrial production fell by 2.9% and retail sales decreased by 11.1%. Investizo thus assumes that Chinese GDP will slow down in the second quarter this year, the first time since the trade wars with the USA. In such a difficult environment, the Chinese regulator continues to hold the interest rate at the current level. At the same time, a loosening of monetary policy looks appropriate, but such a measure would weaken the national currency.

Also worth noting is the growing economic risks in Australia itself. Additional pressure is formed on the backdrop of the parliamentary elections which will be held on 21 May. The ruling party, headed by Prime Minister Scott Morrison, is losing popularity and, according to polls, is falling behind Labor. Australians fear a widespread crisis that has caused consumer confidence to plummet to its lowest level since August 2020. Another negative factor is the attempt of the Australian prime minister to retain his position by introducing controversial economic initiatives. Morrison wants to allow Australian citizens to use their pension savings to buy a home on the primary market. A number of opponents of the current prime minister have already called such a move economic papulism, which will lead to higher real estate prices and increase the price pressure in the economy.

Tomorrow at 03:30 (GMT+2) in Australia the minutes of the last meeting of the Australian regulator will be published. The release of the US retail sales data may also have a significant impact on the pair's dynamics tomorrow at 14:30 (GMT+2).

Support and resistance levels

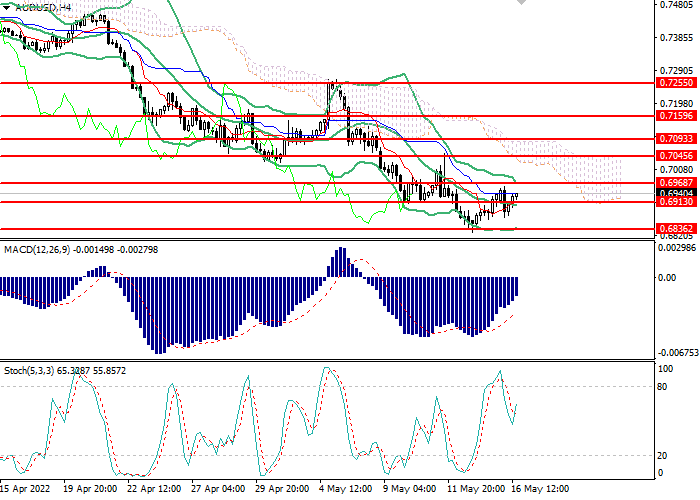

On the 4h chart the instrument is consolidating in the upper range of Bollinger Bands. The indicator has corrected sideways and the price range has contracted, indicating an imminent change in the current trend. MACD histogram is in the negative zone, holding a weak sell signal. Stochastic is approaching overbought area, sell signal may be formed within 1-2 days.- Support levels: 0.6800, 0.6840, 0.6875, 0.6915.

- Resistance levels: 0.6970, 0.7045, 0.7095, 0.7160, 0.7255.

Trading scenarios

- Short positions should be opened at the current price with targets 0.6845, 0.6825 and stop-loss at 0.6980. Implementation period: 1-2 days.

- Long positions can be opened above the level of 0.6985 with a target of 0.7050 and a stop-loss at 0.6955. Implementation period: 1 day.