Current Dynamics

Production of shale oil in the U.S. is lower than projected. Saudi Arabia intends to increase oil production. The EU failed to agree on an embargo on Russian oil. India buys 40 million barrels of Russian oil in the last 2 months.

According to the April forecast of the US Energy Department, production of shale oil in the US in May was expected to reach 8.694 mln barrels per day. However, actual production in May was 8.619 mln barrels per day, which is 0.9% less than forecasted. It is worth noting that the number of wells drilled but not completed in April decreased by 70 units compared to February and amounted to 4.223 thousand. This is due to the fact that the US shale companies are focused on returning money to investors, rather than on increasing oil production on the background of the "green" agenda promoted by D. Biden.

Meanwhile, Venezuela registered in April average level production of oil at the level of 775 thousand barrels per day, which is 47 thousand more than in March. It is worth noting that the average daily oil production in Venezuela in 2021 was 636555 barrels per day.

At the same time, other countries are planning to increase oil production. Iran has declared its desire to double the supply of crude oil to the world market, if buyers are willing. However, Tehran does not publish data on oil production and exports because it is under U.S. sanctions.

Saudi Arabia is considering to increase oil production to 13 million barrels per day by early 2027. Currently, oil production in Riyadh has increased slightly to 10.4 million bpd from 10.28 bpd a month earlier.

Meanwhile, Minister of Foreign Affairs of the EU Josep Borrell said that there are serious disagreements in the EU on the issue about embargo on Russian oil. He also said that the issue is very difficult for a number of countries, especially for such countries as Hungary, which do not have access to sea. On its part, Germany said it would refuse to import Russian oil by the end of the year, even if the EU did not agree to the issue.

At the same time, Libya's Oil and Gas Minister said that the state does not have excessive volumes to supply to the European market in order to compensate Europe for Russian oil.

Russia, in its turn, will lower the export duty on oil by $4.8 to $44.8 per ton from June, 1, which will make Russian oil even more attractive. Since February 24, 2022, Indian importers have placed orders for at least 40 million barrels from Russia. It is worth noting that for the last year India bought only 16 million barrels of oil from Russia.

It can be concluded that the growth of oil production is not fast enough for prices to start decreasing. Economic sanctions against Russia and unsolved conflicts in the north of Africa, together with "smooth " increase of oil production by OPEC+ countries may signal that the growth of Brent oil prices will continue in future.

The American Petroleum Institute (API) will release data on weekly U.S. crude inventories at 22:30 (GMT+2) today. The Energy Information Agency (EIA) will publish data on crude oil inventories tomorrow at 16:30 (GMT+2). Inventories are expected to increase by 1.533M.

Support and resistance levels.

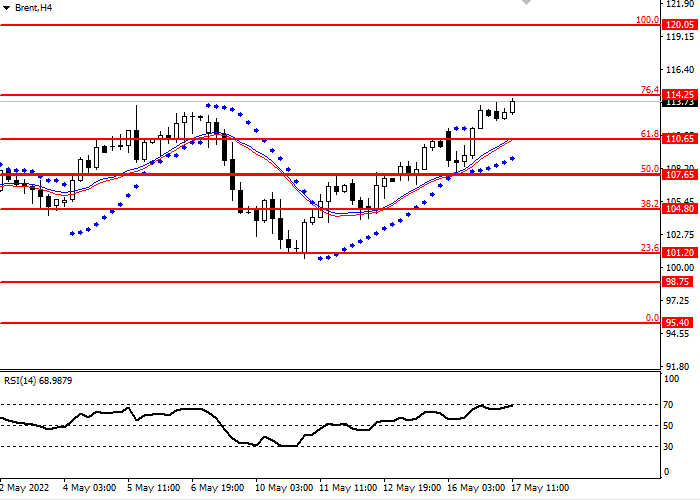

Brent broke through a key Fibonacci level of 61.8 and then moved to consolidation. The current trend is upward. The RSI oscillator is near the 70 level.

- Support levels: 110.65, 107.65,104.80,101.20, 98.75, 95.40

- Resistance levels: 120.05, 114.25

Trading scenarios

- Long positions can be opened above the level of 114.25 with a target of 120.05 and a stop loss of 110.65. Implementation period: 2-4 days

- Short positions can be opened below the level of 110.65, with a target of 107.65 and a stop loss of 111.65. Implementation period: 2-4 days