Current Dynamics

The U.S. Department of Energy reported a decline in strategic stocks. The U.S. State Department allowed two companies to trade oil from Venezuela. Saudi Aramco increased selling prices of oil for Asia. OPEC+ agreed to increase oil production in July and August on 648,000 bpd.The U.S. Department of Energy claimed it had released an additional 40 million barrels of oil from strategic reserves. Nevertheless, oil prices went up to $120 per barrel. The current level of strategic stocks in the U.S. is at its lowest level since 1987. As noted by Bloomberg, from February 22 to May 27, 2022 the volume of reserves decreased by 52.2 million barrels.

Meanwhile, the U.S. State Department has allowed the Italian company "Eni" and the Spanish company "Repsol" to resume oil supplies from Venezuela to Europe. However, the volume of oil received by these companies will not be large, which will have little effect on the market.

The largest oil field in Lebanon has resumed its work after 2 months of its suspension, reports Argus agency. However, there was no statement from the Libyan National Oil Company that it had resumed work.

Meanwhile, Saudi Aramco increased selling prices for July Arab Light for Asia by $2.1 from June levels and will increase prices for the Oman/Dubai basket by $6.5. For Northern Europe and the Mediterranean, the price has been increased by $2.2 and $2, respectively. It is worth noting that prices for US consumers remained unchanged.

At the same time in Russia there has been registered a decrease in oil production by 11.5% (38 mln tons) in April as against March 2022.

At the meeting of OPEC +, which took place on June 2, it was decided to increase oil production in July and August for 648 thousand barrels per day by equal distribution of the September quota.

Meanwhile, Bloomberg, referring to an unnamed source, stated that the oil refining companies in India are planning to sign an extra six months contract with the Russian oil company Rosneft for the supply of oil. It is also worth noting that just now begins the recovery of demand for oil and energy resources in China after the removal of restrictions on major cities, which were implemented earlier due to Covid-19.

Decline in oil production in Russia and the beginning of the recovery of demand in China may point at the fact that oil prices will continue to grow. Currently, the major oil exporters will not be able to increase oil production quickly.

U.S. crude inventories will be released today at 22:30 (GMT+2) by the American Petroleum Institute (API). The Energy Information Agency (EIA) will publish data on crude oil inventories tomorrow at 16:30 (GMT+2). Expect the stocks will decrease by 1.800M.

Support and resistance levels.

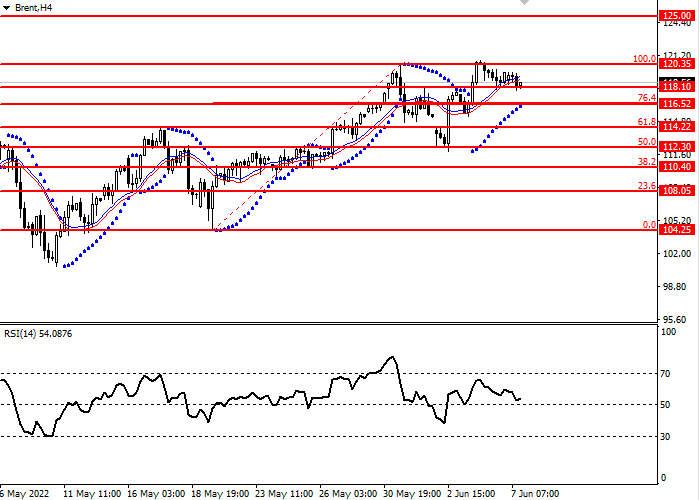

Brent prices have broken through the key Fibonacci level of 100.00 but cannot hold above. The current trend is upward. The RSI oscillator is near the 50 level at the upper part.

- Support levels: 118.10, 116.52, 114.22, 11.30, 110.40, 108.05, 104.25

- Resistance levels: 125.00, 120.35

Trading scenarios

- Long positions can be opened above the level of 120.35, with a target of 125.00 and a stop loss of 118.10. Implementation period: 2-4 days

- Short positions can be opened below the level of 116.52 with a target of 114.22 and stop-loss 118.10. Implementation period: 2-4 days