Current Dynamics.

Japanese farmers are going to cut rice production and start planting wheat and soybeans. Japan's leader said he would set up a working group to fight inflation. The second-largest foreign trade deficit in the history of observations recorded by the Ministry of Finance of Japan in May.

Japanese farmers are going to cut rice production and start planting wheat and soybeans, considering rising grain prices. As of today, 80 percent of the wheat and 90 percent of the soybeans needed for the country's population are bought abroad, for which prices have risen significantly. At the same time, rice consumption and prices in Japan have been declining since 1962 as Japanese lifestyles change and life expectancy declines.

Meanwhile, Japan's government has said that if import prices of wheat remain elevated after September, the government will hold meat prices down by offering compensation to producers to offset higher feed costs. This would reduce production costs for basic agricultural products by about 10 percent to counter rising fertilizer prices.

Along with this, Japanese Prime Minister Fumio Kishida said he would create a task force to fight inflation and stimulate wage growth.

Meanwhile, the second-largest foreign trade deficit in the history of monitoring was fixed by the Ministry of Finance of Japan in May at 2.38 trillion yen ($ 17.7 billion). It is worth noting that in some industries there is a significant reduction in exports. For example, Japan sold cars to China for 36.3% of the lower sum than it was in May 2021. In addition, the volume of exports of the equipment used in the production of microcircuits decreased. It is worth noting that the deficit has been observed for the 10th month in a row and is mainly due to the high cost of raw materials.

At the same time there was negative news in the US labor market and construction sector. U.S. Initial Jobless Claims totaled 229K in May and U.S. Building Permits decreased to 1.695M.

The Bank of Japan is starting to be pressured by the Japanese government to take measures to fight inflation and stabilize the yen. In the U.S., there are negative signals in the labor market, which previously allowed the White House to speak about the strength of the U.S. economy.

Today at 05:00(GMT+2) will release the Bank of Japan Monetary Policy Statement and the Japan Interest Rate Decision. Later that day at 14:45(GMT+2) will be the U.S. Fed Chair Powell Speaks.

Support and Resistance Levels.

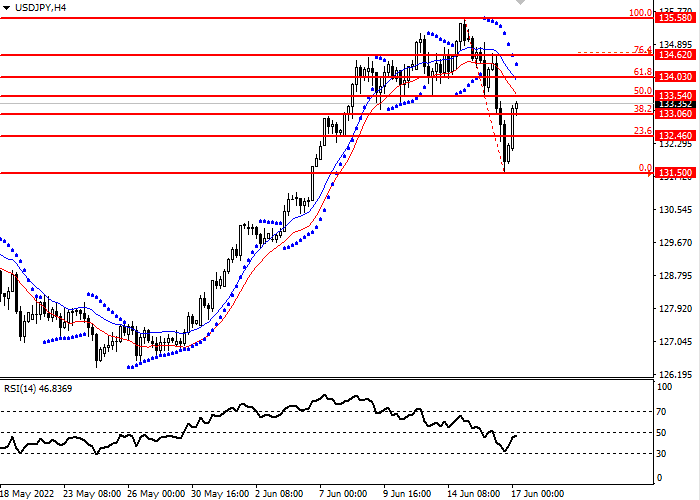

The USD/JPY returned to growth after a strong move lower and locked above the key Fibonacci 38.3 level. The current trend is upward. The RSI oscillator touched the 30 level and went up. The RSI oscillator is below 50.

- Support levels: 133.06, 132.46, 131.50

- Resistance levels: 135.58, 134.62, 134.03, 133.54

Trading scenarios

- Long positions can be opened above the level of 133.54 with a target of 134.62 and a stop loss of 133.06 : Implementation period: 1-3 days

- Short positions may be opened below the level of 133.06 with a target of 131.50 and a stop loss of 133.54: Implementation period: 1-3 days