Fundamental analysis of XAU/USD

Gold (XAU/USD) showed an upward trend on Friday, rising to 1926.90 and is trading flat.

This positive dynamic is especially noticeable against the backdrop of a strong U.S. dollar and rising bond yields. Central banks in the world's major economies are signaling their willingness to keep interest rates high, mainly due to concerns about slowing global economic growth and curbing inflation. Despite gold's reputation as a stable hedge against economic fluctuations, it still faces the challenge of rising interest rates, which could negatively impact the value of precious metals in gold.

Gold's current uptrend, which interrupted a three-day decline, has emerged without any clear fundamentals and signals possible volatility in the future. Of note, the US Federal Reserve left interest rates unchanged but hinted at the possibility of an interest rate hike in the short term. The more hawkish stance has led to a slight decline in spot gold prices, but many in the US expect lower interest rates in the future. Market sentiment predicts a 45% probability of a rate hike this year and a 44% probability of a rate cut by early 2024. In the context of these forecasts, the Bank of Japan has chosen an extremely high level of interest rate hikes. Interest rates are rising in anticipation of the release of key PMI data for major economies such as the UK, US and Eurozone. Further insight into the Fed's views is provided by a dot plot showing that the benchmark interest rate could reach 5.1% in 2024. This suggests that only two interest rate cuts are expected next year, down from the four previously expected. These forecasts are supported by the latest U.S. labor market data, which showed a decline in new claims for unemployment benefits and indicate a strong labor market. With US Treasury yields currently high, future increases in gold prices are likely to be associated with significant changes in these yields.

Market observers are keeping a close eye on upcoming U.S. unemployment data and Federal Reserve statements as they may provide valuable clues regarding policy and regulatory adjustments. The world's attention is currently focused on the upcoming PMI data, which will provide insight into the global economy. This data will certainly influence market sentiment and determine demand for "safe-haven" assets such as gold. Given the current situation, investors should be cautious and wait for a concrete buy signal before committing to a higher XAU/USD price.

Technical Analysis and Scenarios:

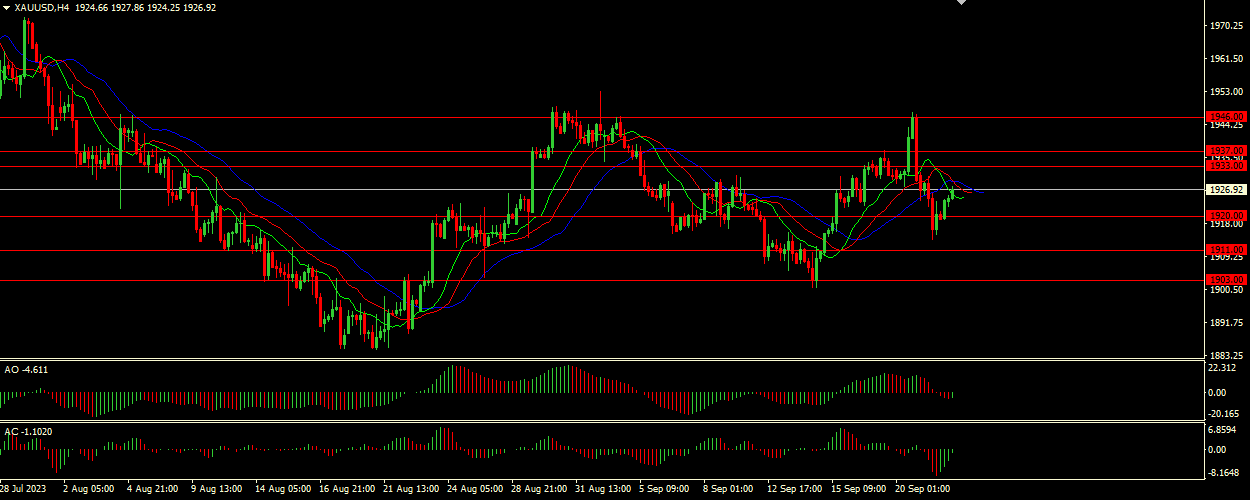

The dormant state of the Alligator signifies indecisiveness in the market. This calls for a more cautious approach as breakout directions can be unpredictable. AO and AC being in the green zone is a confirming buy signal, which indicates the possibility of an upward momentum in the near term.

Main scenario (BUY)

Recommended entry level: 1933.00.

Take Profit: 1937.00.

Stop-loss: 1930.00.

Alternative scenario (SELL)

Recommended entry level: 1920.00.

Take Profit: 1911.00.

Stop loss: 1925.00.