Fundamental analysis of EUR/USD

The EUR/USD currency pair has been fluctuating lately on the back of European and American economic indicators. The price is currently trying to recover from the fall and is trading at 1.07770.

Key economic indicators from Europe and the US are in focus and may affect the short-term trend of the pair. Eurozone GDP data for the third quarter is of great importance. The European Central Bank is expected to move to a faster rate hike. According to preliminary estimates, the Eurozone economy contracted by 0.1% in the third quarter, mainly due to consumer spending and services.

Also, market conditions may be influenced by comments from Central European Bank President Christine Lagarde. However, ECB Governing Council member Isabelle Schnabel had previously indicated the need to raise interest rates, but her stance has changed as the latest inflation data has fallen and markets are now laying on a lower ECB interest rate next year.

The focus is on U.S. jobless claims data, which is expected to rise slightly from 218k to 222k for the week ended December 1. This data, along with the upcoming US jobs report, is important in shaping expectations for the government's monetary policy. A rise in jobless claims could signal a deterioration in the labor market, which could slow wage growth and reduce the unemployment rate, affect consumer spending and increase it. This trend could support the Fed's looser monetary policy.

The US Dollar Index rose despite a weaker-than-expected ADP employment report, suggesting that demand for the dollar is on the rise again. However, the euro rose against the dollar in early Asian trading on Thursday. Eurozone trade data is also under pressure.

Overall, the direction of the EURUSD currency pair depends on a combination of Eurozone economic data, ECB policy expectations and US employment statistics. The market's focus is on the upcoming US employment report and the central bank's outlook. A slowdown in US inflation could signal a change in the Federal Reserve's stance, which will affect the demand for the US Dollar.

Technical analysis and scenarios:

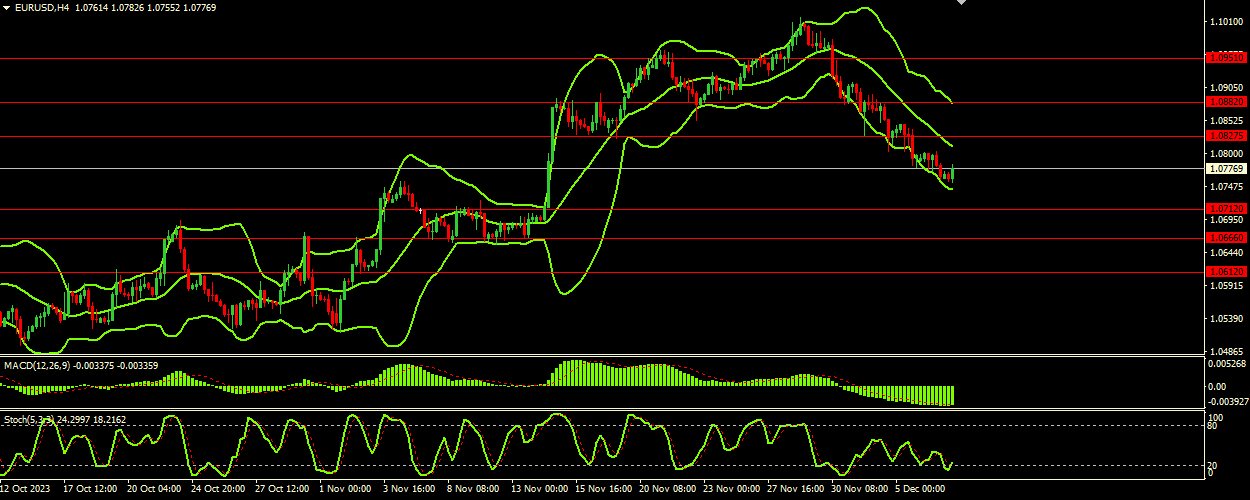

The Stochastic Oscillator indicator indicates that the EUR/USD pair is currently in or close to oversold territory. This could indicate a potential reversal or pullback in price as sellers may start to lose momentum. The MACD value is very close to its signal line, indicating that there is no strong momentum in either direction. This near zero divergence indicates a period of consolidation or indecision in the market. The price movement in the lower range of the Bollinger Bands and the downward directionality of the bands indicate bearish pressure. A wide range between the bands indicates high volatility.

Main scenario (SELL)

Recommended entry level: 1.07120.

Take Profit: 1.06660.

Stop loss: 1.07500.

Alternative scenario (BUY)

Recommended entry level: 1.08275.

Take Profit: 1.08820.

Stop loss: 1.08000.