Fundamental analysis of XAU/USD for 19.02.2024

Gold market dynamics are characterized by a subtle mix of economic, geopolitical and political factors, resulting in a mixed and positive outlook for the XAU/USD currency pair.

Gold prices continue to rise despite mixed global economic data and geopolitical tensions and are currently trading at 2020.00. The bold move in gold prices is closely linked to the weakness of the US dollar and rising tensions in the Middle East, indicating demand for the metal as a safe-haven asset in times of uncertainty. This situation was strongly influenced by comments from San Francisco Fed President Mary K. Daley, who favors a cautious approach to economic intervention and a possible rate cut in 2024.

Investor sentiment is also influenced by the release of key economic data such as the Consumer Price Index, Producer Price Index and Retail Sales, which together show inflation trends, spending patterns and consumers and provide insight into the economic outlook. It is worth noting that despite the Fed's policy outlook and dollar fluctuations, the PPI data improved year-over-year, which boosted sentiment in the gold market. Discussions among Fed officials, including an interest rate hike proposed by former Fed official James Bullard, will provide more protection to market expectations, with CME Fedwatch showing uncertainty in the timing of rate cuts in the near term. These discussions, along with expectations of key economic reports from the Fed, highlight the important role that monetary policy plays in shaping gold's short-term rate path.

Overall, the combination of a weaker dollar, geopolitical concerns, and speculation regarding the Fed's monetary policy actions creates a more positive outlook for gold. Investors will exercise caution and monitor inflation figures, Fed statements and global economic developments to determine the direction of gold prices. This cautious mindset, as well as the complex relationship between market sentiment and policy expectations, summarizes the current state and future outlook for the XAU/USD market.

Technical Analysis and Scenarios:

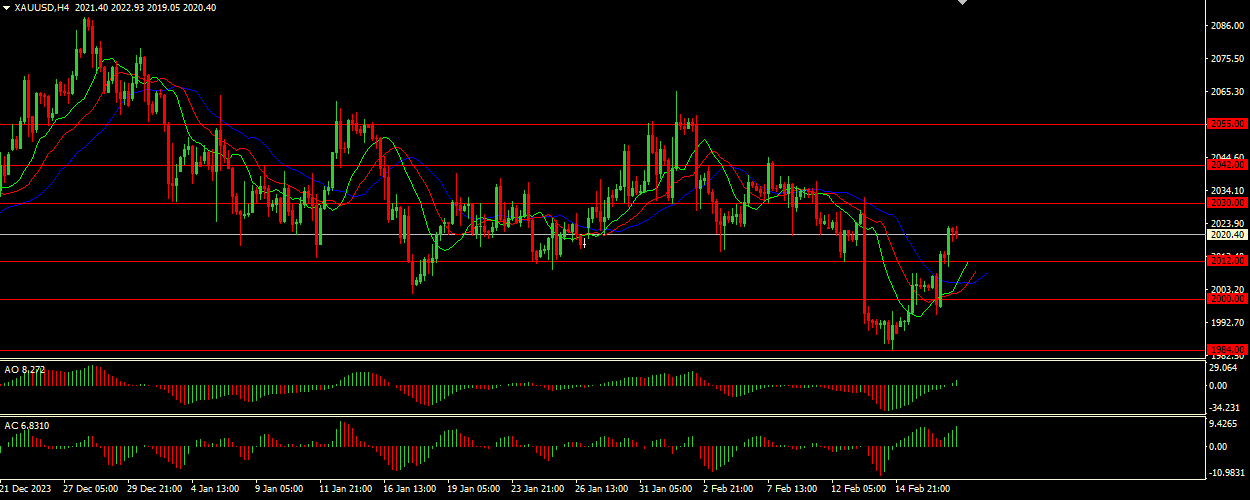

The Alligator indicator indicates that the XAU/USD pair is in an uptrend due to its hungry condition: the jaw (blue line) is below the lips and teeth (green and red lines), indicating strong buying pressure. In addition, the Awesome Oscillator (AO) and Accelerator Oscillator (AC), which are in the green zone, provide further confirming signals for a bullish trend.

Main Scenario (BUY)

Recommended entry level: 2030.00

Take Profit: 2042.00

Stop Loss: 2025.00

Alternative scenario (SELL)

Recommended entry level: 2012.00

Take Profit: 2000.00

Stop loss: 2017.00