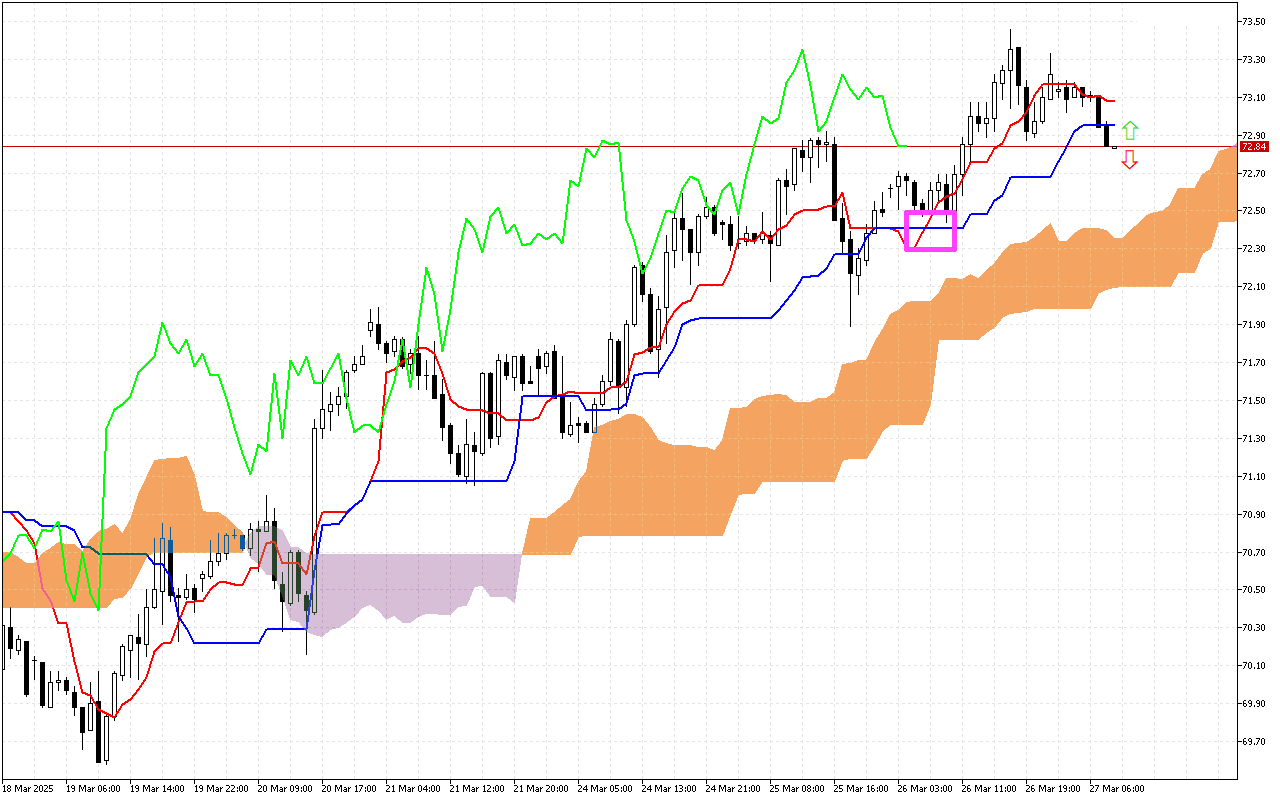

Brent H1: Ишимоку прогноз на европейскую сессию на 27.3.2025

Текущая ситуация

Давайте внимательно рассмотрим текущие значения основных составляющих индикатора Ишимоку, чтобы оценить состояние рынка на данный момент:

Цена находится ниже линий Tenkan и Kijun, которые не успели отреагировать на изменение рыночной ситуации.

Динамика движения цены на более длинной дистанции определяется облаком Kumo, которое сейчас окрашено в оранжевый цвет. Поэтому данный сигнал отдает приоритет восходящему вектору движения цены в будущем.

Сейчас линии облака Kumo представляют собой динамическую область поддержки для цены.

Используемая инвесторами для определения смены тенденции, зеленая линия Chikou на графике удерживается под ценой.

Торговые рекомендации:

Динамические уровни поддержки находятся на линиях Kijun, около отметки 72.95, SenkouA, на уровне 72.40 и SenkouB, около 72.09.

Динамический уровень сопротивления находится на линии Tenkan, в районе отметки 73.09.

По итогу анализа большинство компонентов индикатора Ишимоку указывают на предстоящий рост цены. Поэтому внутри дня стоит отдавать предпочтение длинным позициям, которые можно рассматривать от обозначенных уровней поддержки.