Current dynamics

USD/CAD continues its sequential decline after a partial rise on Monday with a consolidation around 1.2835

The USD/CAD pair failed to consolidate the result of Monday’s intraday rise caused by the weakening intensity of US Treasury bond yields leading to greenback sell-offs. Further declines in quotes were driven by falling prices for crude oil, traditionally Canada’s main export item.

The fall in crude oil prices is due to a continued decline in demand from the People’s Republic of China, triggered by covid restrictions. This situation is reflected by weak macroeconomic data released on Monday. The fall in oil prices could have been much greater. Both waiting for European Union decisions on embargo on Russian energy imports and reduction of global supply of this resource in general, caused among other things by very modest increase of production and export by OPEC+ countries, significantly sloweddown the fall of black gold quotations.

The expectation of further tightening of the monetary policy affects the strengthening of the US dollar. Earlier Fed Chairman Jerome Powell promised a key rate hike of 50 b.p. (and possibly 75 b.p.) at each of the next two meetings, which will inevitably lead to a strengthening of the national currency. This in turn creates a bullish mood for the USD/CAD pair today.

The strong position of the greenback is also influenced by the difficult geopolitical situation: macroeconomic risks, the expected possible recession caused by the prolonged nature and the escalation of the armed conflict in Ukraine further contribute to a reduction of risk appetite of investors, which led to the yield of 10-year US government bonds dropping from a local high. Nevertheless, such trends in the longer term are increasing the demand for the USD as a safe haven currency, setting the stage for USD/CAD growth.

In addition to all of the above, important factors determining the pair’s future fate are expected news releases on the following data: US retail sales and speeches by FOMC member Loretta Mester and Fed Chair Jerome Powell on Tuesday, Canadian CPI and US crude oil inventories on Wednesday.

Support and resistance levels

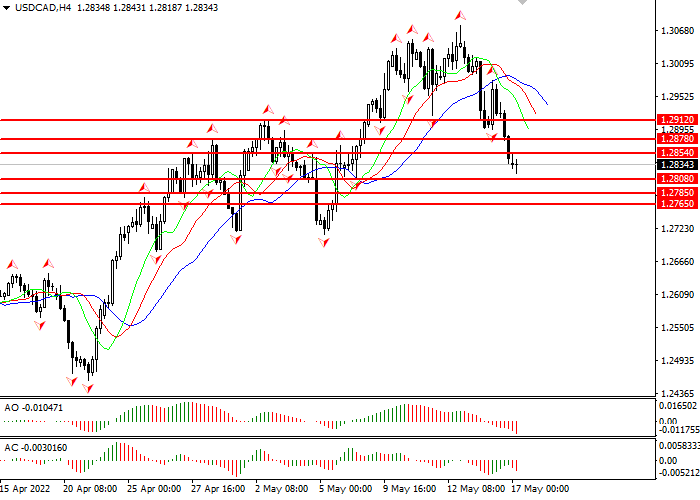

Alligator is hungry: his mouth is wide open, his jaw (blue line) hovers high above his lips and teeth (green and red lines), the instrument is in a downtrend. The nearest fractal below the alligator’s teeth (red line) is at 1.28947

Awesome Oscillator (AO) and Accelerator Oscillator (AC) are both in the red area, which is a confirmatory sell signal.

- Support levels: 1.28080, 1.27850, 1.27650

- Resistance levels: 1.29120, 1.28780, 1.28540

Trading scenarios

- Short positions should be opened at the 1.28080 with target 1.27850and stop-loss at 1.28350. Implementation period: 1-2 days.

- Long positions can be opened at the 1.28540 with a target of 1.28780 and a stop-loss at 1.28350. Implementation period: 1 day.