Fundamental analysis USDJPY for 20.03.2024

The Japanese Yen (JPY) continues its downward spiral, marking a seven-day streak as it plunges to a fresh four-month low against the US Dollar (USD) ahead of the European session. The Bank of Japan's (BoJ) recent announcement, although historic, lacked forward guidance on policy normalization, causing disappointment among hawkish traders. Despite ending its negative interest rate policy and signaling its first rate increase since 2007, the BoJ's commitment to maintaining accommodative monetary conditions tempers any immediate bullish sentiment for the JPY. The prevailing risk-on sentiment further diminishes the JPY's appeal as a safe-haven currency.

The Bank of Japan has said it will reduce its purchases of commercial paper and corporate bonds, but will continue buying government bonds and intervene as necessary if yields become too high and rise rapidly. But the lack of prospects for further tightening disappointed the Bank of Japan's hawkish traders and continued to weigh on the Japanese yen, sending it to its lowest level since November 2023 on Wednesday.

Conversely, the USD maintains its strength near a two-week high, fueled by expectations that the Federal Reserve (Fed) will adhere to its stance on higher interest rates to combat inflation. This narrative supports the ongoing positive trajectory of the USD/JPY pair beyond the mid-151.00s. However, concerns loom regarding potential intervention by Japanese authorities amidst the sharp depreciation of the JPY, which could impede further gains.

Speculation surrounding the Fed's monetary policy direction intensifies as robust US consumer data suggests a potential adjustment in forward guidance, possibly reducing the projected number of rate cuts in 2024. All eyes are on the highly anticipated two-day FOMC meeting for updated economic projections, particularly the "dot plot," which will provide insights into the future rate-cut path. Despite hawkish expectations bolstering US Treasury bond yields and favoring USD bulls, intervention fears and uncertainties surrounding the timing of Fed rate hikes pose challenges for the USD/JPY pair.

Attention turns to the US Federal Reserve, with expectations of interest rates remaining unchanged. However, market sentiment hinges on the Fed's projections and press conference, particularly regarding the timing of potential rate cuts. Recent US inflation data has tempered expectations of an early rate cut, potentially impacting riskier assets and influencing the trajectory of the USD/JPY pair. Despite fluctuations, uncertainty surrounding Fed rate hikes underscores the potential for a volatile trading session for the USD/JPY on Wednesday.

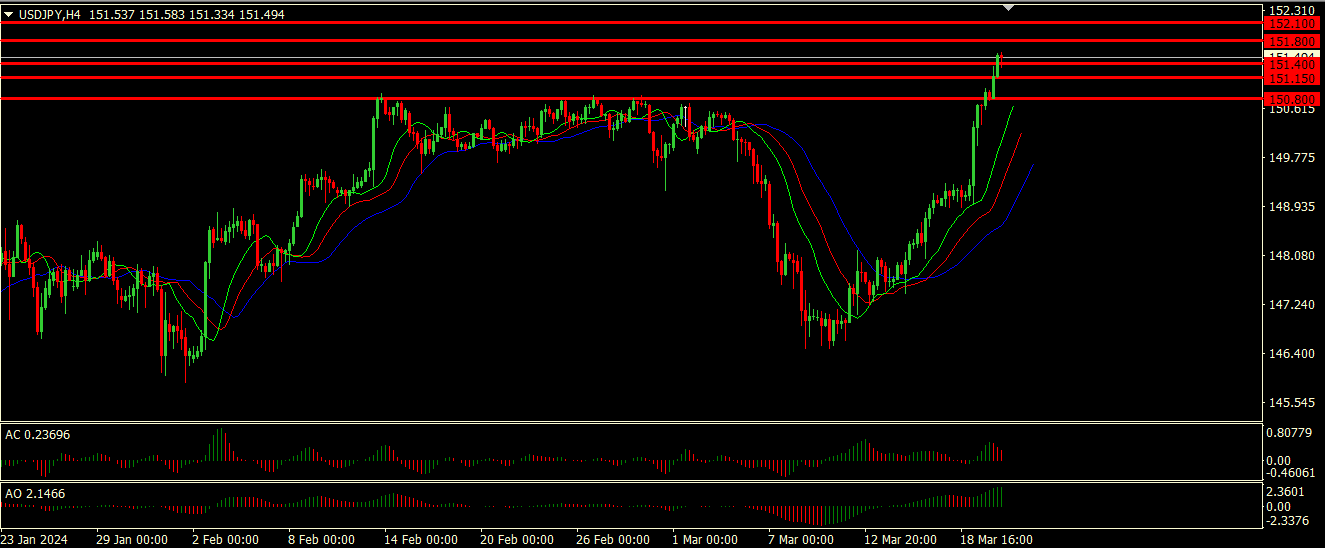

Technical analysis and scenarios:

Alligator: Hungry with a clear uptrend, indicating bullish momentum. The jaw (blue line) is below the lips and teeth (green and red lines), which confirms the opinion that there is a bullish trend. Awesome Oscillator (AO) in the green area and Accelerator Oscillator (AC) in the gray area, showing divergence. This divergence suggests that although the market is bullish, a trend reversal or slowdown in bullish momentum is possible. Given the current momentum, USD/JPY may try to test the first resistance at 151.400. If it breaks this level, then the next targets will be 151.150 and 150.800.

Main scenario (BUY)

Recommended entry level: 151.400.

Take profit: 151.800.

Stop loss: 151.150.

Alternative scenario (SELL)

Recommended entry level: 151.150.

Take profit: 150.800.

Stop loss: 150.400.