Current Dynamics.

The NZD/USD is surging on fresh news confirming the Reserve Bank of New Zealand's (RBNZ) expected 50bp key rate hike and is currently wavering at 0.6500. The last time the pair traded at such level was at the beginning of May.

The central bank also released impressive estimates of further interest rate hikes in an effort to cope with steadily rising inflation. According to the plans, the rate will climb to a maximum of 3.9% in June 2023. The previous forecast for that date was 3.4%, but that rate is now expected by December 2002.

Despite the fact that the increase of the key rate always leads to the growth of the national currency quotes, the market has enough factors that can prevent the rapid growth of NZD/USD. Among them is an ambiguous situation with the appetite for risk.

On the one hand, the stock markets continue to grow consistently, unlike American treasuries, which slowed down amid negative news on housing construction, the U.S. dollar, therefore, weakens. This pattern is appropriate for a dynamic that supports investment in high-yielding currencies such as the "kiwi".

But at the same time, the collapse of hopes for a soon significant easing of the COVID-19 epidemiological restrictions in the People's Republic of China, the continuation of the lockdown until the end of the month, affects the "kiwi" not in the best way, because China is the largest importing country, consuming more than 25% of New Zealand's exports. Investors in the New Zealand dollar also have doubts about the prospects of New Zealand's strategic relationship with the United States in the context of IPEF, which is obviously anti-China, which can significantly worsen the economic relationship.

The publication of the data on April basic orders for durable goods in the United States (the expected value - 0.6%, the positive deviation from the expected one leads to the dollar's strengthening) and the protocols of the Federal Open Market Committee (FOMC) should be referred to the considerable forthcoming news able to influence the price dynamics on the NZD/USD pair. Both publications are expected during the day.

Support and resistance levels.

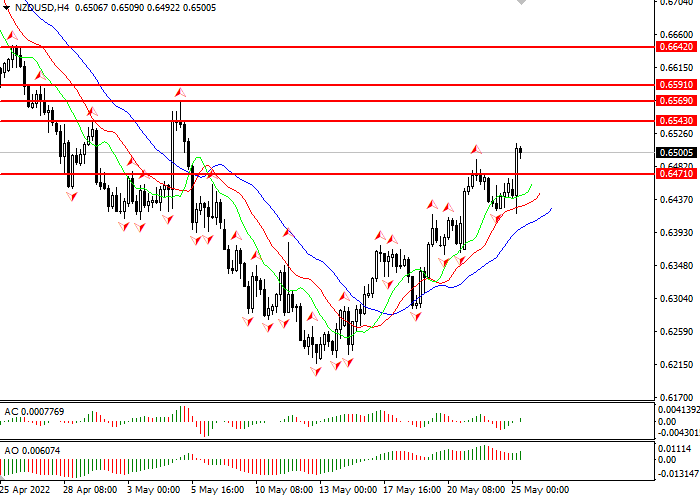

Alligator is hungry: its mouth is wide open, its jaw (blue line) is low under the lips and teeth (green and red lines), the instrument is in an uptrend. The nearest fractal above the alligator’s teeth (red line) is at 0,64710. Awesome Oscillator (AO) and Accelerator Oscillator (AC) are both in the green area, which is a confirmatory buy signal.

- Key levels: 0.66420, 0.65910, 0.65690, 0.65430, 0.64710

Trading scenarios

- Buy limit position may be opened from the level 0.64710 with target 0.65430 and stop-loss 0.64370. Implementation period: 1-3 days

- Sell limit position may be opened from the level of 0.65430 with target 0.64710 and stop-loss 0.65690Implementation period: 1-3 days