Fundamental analysis of WTI

In recent trading sessions, oil prices, particularly for the US benchmark WTI grade, have been under downward pressure. On Thursday, the price of WTI crude oil fell slightly, reaching an almost one-week low of $88.60 per barrel. This price fluctuation is primarily due to the hawkish stance of the U.S. Federal Reserve, which left interest rates unchanged, but at the same time made it clear that they may be raised before the end of the year.

Fed Chairman Jerome Powell's statement on the need to keep inflation at 2% underscores the central bank's willingness to adjust rates if necessary. With potential rate hikes in the U.S., the cost of borrowing is rising, which poses a threat to the broader economy and, as a result, to oil demand. The strengthening of the US dollar, which reached its highest value since March due to the Fed's decision, is another factor affecting oil prices. As a stronger dollar makes oil more expensive for traders trading in other currencies, demand for dollar-denominated WTI crude could suffer.

However, this bearish pressure is countered by persistent global supply problems. The recent voluntary oil production cuts by heavyweights Saudi Arabia and Russia, which will last until the end of 2023, are playing a significant role. The Saudi production cuts are expected to stabilize production at around 1.3 million barrels per day. This cut, as well as OPEC's continued production curbs, has heightened fears of a global supply shortage, especially as the fourth quarter approaches.

Confirming these fears, Cushing, a key supply point for WTI crude, reported inventory levels at their lowest level since July 2022. Contrasting inventory data also played a role in market sentiment. While the American Petroleum Institute predicted a 5.25 million barrel decline in inventories, the U.S. Energy Information Administration reported a decline of only 2.14 million barrels. The potential supply shortfall in Q4 could exceed 2 million barrels per day, hinting at the possibility of more oil price strength in the near future.

Overall, while the oil market remains overshadowed by the Fed's monetary policy decisions and the global economic situation, supply concerns are creating bullish conditions for the short-term trajectory of oil prices. Traders and investors should remain vigilant as they navigate the subtle interplay of these factors.

In the coming days, traders will be closely watching such key U.S. economic indicators as weekly jobless claims, sales in the secondary real estate market and the preliminary U.S. PMI for September. These data affecting the US dollar will inevitably have an impact on WTI prices.

Technical analysis and scenarios:

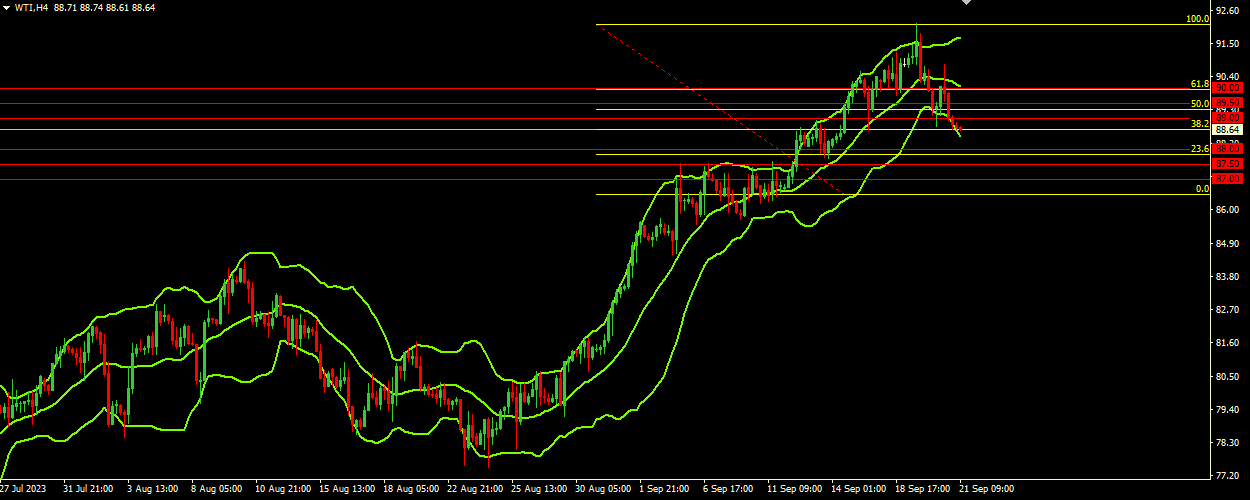

WTI crude oil, currently priced at 88.60, is just above the 88.00 immediate support level. With the Bollinger Bands indicating a widening price range and the current price near the lower band at $88.40, oil has entered a bearish trend. Given the downward direction of the Bollinger Bands and the fact that the price is trading in the lower range of the indicator, there is a possibility that the price will test lower support levels in the coming days.

Main scenario (SELL)

Recommended entry level : 88.00.

Take Profit: 87.50.

Stop Loss: 88.25.

Alternative scenario (BUY)

Recommended entry level: 89.00.

Take Profit: 89.50.

Stop loss: 88.75.