Current dynamics

The USD/CAD pair opened todays trading session with a decline. The Canadian dollar continued its gains for the second session in a row, after the pair reached its highest level at 1.30787 in last Fridays session.

Combined with the US holiday, the light calendar and traders hesitation about the next market moves, along with their fears of faster monetary policy tightening and an economic slowdown, all of this put downward pressure on the US dollar.

However, US Treasury Secretary Janet Yellens statements came to confirm that a recession is not inevitable in the United States, with expectations of a slowdown in the economy in the midst of its transition to slow and stable growth.

On the other hand, according to statements by members of the US Federal Reserve, the US Central Bank is determined to continue raising US interest rates without regard to fears of economic stagnation until US inflation stops its record rise.

A member of the US Federal Reserve and President of the St. Louis Federal Bank, James Bullard, expressed that more interest rate hikes are coming in the upcoming meetings, and assured that the economic expansion will continue in the current year, speaking about the labor market, saying that it is still solid, and indicates the strength of the US economy.

Over the weekend, Federal Reserve Board member Christopher Waller also said that he supports a 75 basis point rate hike in July if the data comes out as expected.

On the other hand, the US dollar index DXY is still extending the beginning of the week’s losses to 104.30, down 0.20%, while the 10-year US Treasury yields recorded a three-day bullish trend around 3.284%.

All eyes will be on as Federal Reserve Chairman Jerome Powell will testify in his semi-annual monetary policy report before the Senate on Wednesday and will repeat his statement before a different committee on Thursday, where market participants will look for clues about economic developments in the US.

Looking at the most important events that may affect the pair’s performance, on the American side, in addition to Jerome Powells statements on Wednesday and Thursday, there will also be a reading of the final consumer confidence in Michigan for the month of June, and this week we will also see the results of the existing home sales indicators, along with orders mortgage and initial unemployment benefits claims.

On the Canadian side, the retail sales data for the month of April will be significant on Tuesday, as core sales are expected to come in at 0.8%, up from 0.2% in March, while sales excluding cars are expected to come in at 0.6%, down from the previous 2.4% in March and the CPI for May, which is expected to come in at 0.4%, compared to 0.7% in April.

Support and resistance levels

Support and resistance levels

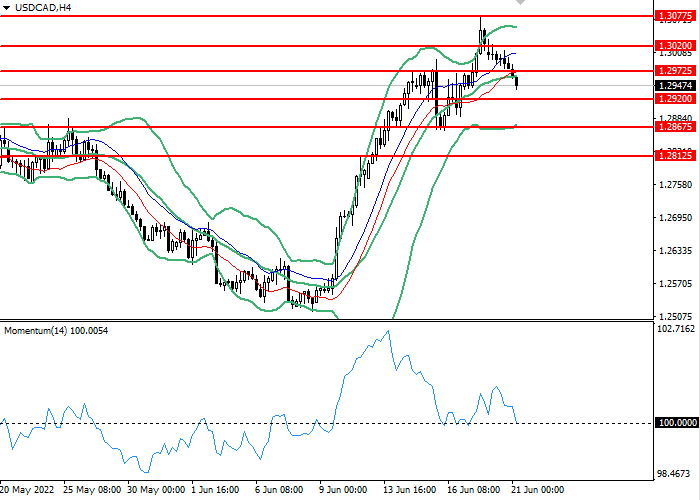

On the 4 hour chart, the instrument failed to consolidate above the Bollinger Bands moving average. The indicator is directed downward and the price range has shrunk, indicating that the current trend is about to change.The momentum chart is above the 100 level, which gives sell signals. The Envelopes indicator gives buy signals.

- Support levels: 1.30775, 1.30200, 1.29725.

- Resistance levels: 1.29200, 1.28675, 1.28125.

Trading scenarios

- Long positions should be opened at the 1.29200 with a target of 1.29725 and a stop loss at 1.281675. Implementation period: 1-3 days.

- Short positions can be opened above the level of 1.28675 with a target of 1.28125 and a stop-loss at the level of 1.29200. Implementation period: 1-3 days.