Current Dynamics

Growth in manufacturing activity in Japan slowed in June. Sales at Japanese department stores increased for the third month in a row. Political parties in Japan are focusing on raising wages for citizens in their pre-election campaigns. IMF supports the U.S. Federal Reserve's decision to increase the benchmark interest rate up to 3.5-4%Growth in manufacturing activity in Japan slowed in June. It is worth noting that overall new orders declined for the first time in nine months because of increasing pressure on already disrupted supply chains, while output is growing at its slowest pace in 3 months.

At the same time, department store sales in Japan have increased for the third month in a row. Sales are up 57.8% compared to 2021. Consumer demand for luxury goods such as precious metals and jewelry has revived along with high demand for summer clothing. However, sales were lower on 10.5 % compared to three years ago.

Meanwhile, within the framework of pre-election race political parties in Japan put measures aimed to raise the minimum wage, as well as tax benefits at the forefront of their campaigns.

It is also worth noting that Japan's first central government has issued a warning about energy shortages. Japanese government asks citizens to make efforts to save electricity, especially from 15 to 18 hours.

Meanwhile, the International Monetary Fund supports the U.S. Federal Reserve's policy of raising the benchmark interest rate to 3.5-4% to fight high inflation. The Fund forecasts U.S. GDP will reach 1.7% this year and 0.8% in 2023. According to the Fund, the inflation will reach 5.4% at the end of this year and in 2023 it will be around 2%. It also follows from the IMF statement that the USA has less and less chance to avoid recession. It should be reminded that the inflation rate in the USA is now fixed on the level of 8.6%.

A weak yen makes Japanese industry a more attractive place to invest, but further weakening could severely lower the purchasing power of the Japanese. At the same time, the US will continue to tighten its monetary policy but it could lead to a recession and further manufacturing shutdowns.

Today at 07:00(GMT+2) will be released Japan Leading Index MoM, Japan Leading Index MoM, Japan Coincident Indicator MoM later in the day at 14:30(GMT+2) will be released U.S. Core Durable Goods Orders MoM and at 16:00 (GMT+2) will be released U.S. Pending Home Sales MoM.

Support and resistance levels.

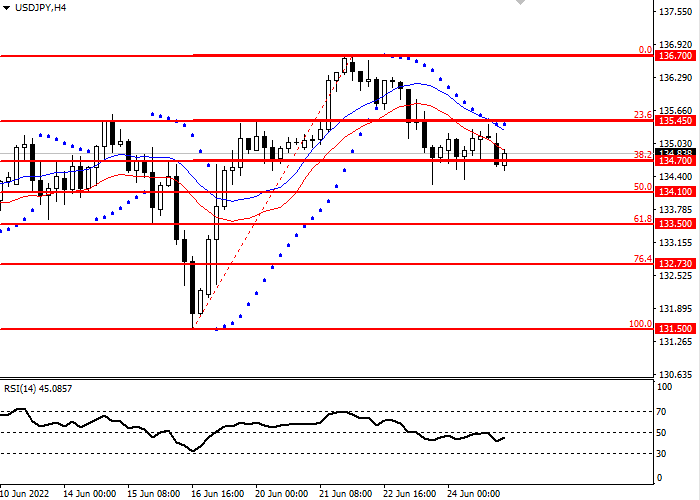

The USD/JPY fell below a key Fibonacci 38.2 level on Monday. The RSI oscillator is below 50.

- Support levels: 134.70, 134.10, 133.50, 132.73, 131.50

- Resistance levels: 136.70, 135.45,

Trading scenarios

- Short positions can be opened from the current level with a target of 133.50 and a stop loss of 135.45 : Implementation period: 1-3 days

- Long positions can be opened above the level of 135.45 with target 136.70 and stop-loss 134.10: Implementation period: 1-3 days