Current Dynamics

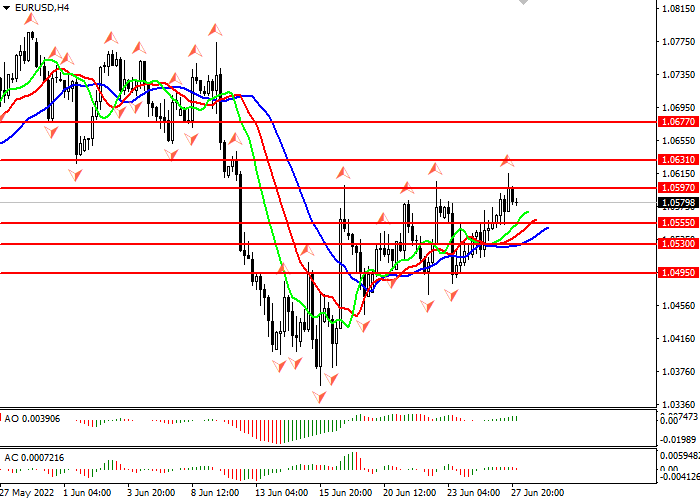

The EUR/USD is heading down from two-week highs to a support level at 1.05800

The EUR/USD failed to break through the resistance level around 1.06000 amid fears of economic recession and upward trends in Eurozone inflation indicators, and at the moment the pair is declining in correction, trading in flat at the nearest support level, formed over the last two weeks around 1.05800.

The latest rise in the pair was caused by the bulls positive expectations for the further growth in quotations because of the ambiguous macroeconomic data on the USA along with the coming hypothetical increase in the key rate by the European Central Bank.

On the European side, the reason for the pair to enter the correction, most likely, is the factor of the geopolitical tension caused by the armed conflict in Ukraine. Thus, the rhetoric of the Russian Federation representatives in response to the announcement of the technical default and prohibition of the transit of critical economic resources by the Lithuanian government causes a natural pressure in Western Europe. Among other things, it is much more difficult for European countries in the current situation to cope with disruptions in production supply chains than it is for the United States.

On the greenback side the reasons for the current trend are the following positive data that came out yesterday and pleased the bulls on the US dollar: The volume of durable goods orders for May rose much stronger than expected - 0.7% against the expected 0.1% and the previous 0.4%. A similarly strong data release was also seen in the Pending Home Sales Index for May, also 0.7%, but this time the gap with the expected number was even bigger (-3.7% vs. -4.0% for the previous month). However, this is just local good news for the North American economy as the stock market continues its decline and Treasury yields continue to rise.

The macroeconomic news, is to be published soon and which may affect further movements of the pair, are the speeches of ECB Chairman Lagarde and ECB representatives Lane, Elderson and Panetta. On the US side is the Consumer Confidence Index for June. The above data will be released later today.

Support and resistance levels.

Alligator is hungry: its mouth is wide open, its jaw (blue line) is low under the lips and teeth (green and red lines), the instrument is in an uptrend. The nearest fractal above the alligators teeth (red line) is at 1.05970. Awesome Oscillator (AO) and Accelerator Oscillator (AC) are both in the green area, the bars are close to the zero level, which is a strong confirmatory buy signal.

- Support levels: 1.04950, 1.05300, 1.05550

- Resistance levels: 1.05970, 1.06310, 1.06770

Trading scenarios

- Short positions can be opened from the level of 1.05550 with a target of 1.05300 and a stop loss of 1.05750: Implementation period: 1-3 days

- Long positions can be opened from the level of 1.05970 with a target of 1.06310 and stop-loss of 1.05750: Implementation period: 1-3 days