Fundamental analysis of GBP/USD

The GBP/USD pair is showing significant strength, with sterling rising slightly above the key resistance level of 1.2900. This is mainly due to solid labor cost data, which points to the possibility of a large-scale rate hike by the Bank of England. In response to labor shortages, UK businesses are offering higher wages to attract new talent, offsetting the impact of rising unemployment.

The three-month UK unemployment rate rose to 4.0% from the previous report with a consensus forecast of 3.8%, and the latest employment data fell short of expectations. Many companies prefer to avoid high-interest loans in the current financial environment. On the other hand, the change in the number of job seekers for June increased significantly to 25.7k, indicating an increase in the number of job seekers after a decline in the previous month to 22.5k. Despite the volatility in the labor market, the prospect of a significant rate hike by the Bank of England (BoE) remains firm. Three-month average earnings excluding bonuses maintained a solid growth rate of 7.3%, ahead of the forecast of 7.1%. Thus, with an increase in disposable income, households may increase their overall purchasing power, which could ultimately lead to higher price pressures.

Bank of England Governor Andrew Bailey reiterated the bank's commitment to keep a close eye on the labor market to achieve the 2% inflation target. Meanwhile, UK Foreign Secretary Jeremy Hunt emphasized that the government and the central bank will take the necessary steps to reduce downward pressure on prices. Market participants currently expect the Bank of England to raise rates in the range of 6.25-6.50%. Inflation in the UK economy has slowed from its peak of 11.1%, although Prime Minister Rishi Sunak's target of halving inflationary pressures by the end of the year may not be achieved.

This week's UK economic calendar will see the release of labor market data, followed by the Financial Policy Council (FPC) minutes on Wednesday and Thursday in the Industry and Manufacturing data section. Industrial production and monthly gross domestic product (GDP) are expected to decline 0.4%, while manufacturing is expected to decline 0.5%.

The U.S. Dollar Index (DXY) is currently down for the third consecutive day as investors anticipate a one-time Fed rate hike. The key data this week will be US consumer price index (CPI) data. Preliminary reports showed a 0.3% increase in the monthly CPI from the previous reading of 0.1%. Core inflation, which excludes food and oil prices, should be in line with the core CPI. Comments from FOMC members Barr, Bostic and Daley suggest that the Fed's tightening cycle is coming to an end.

Technical analysis and scenarios:

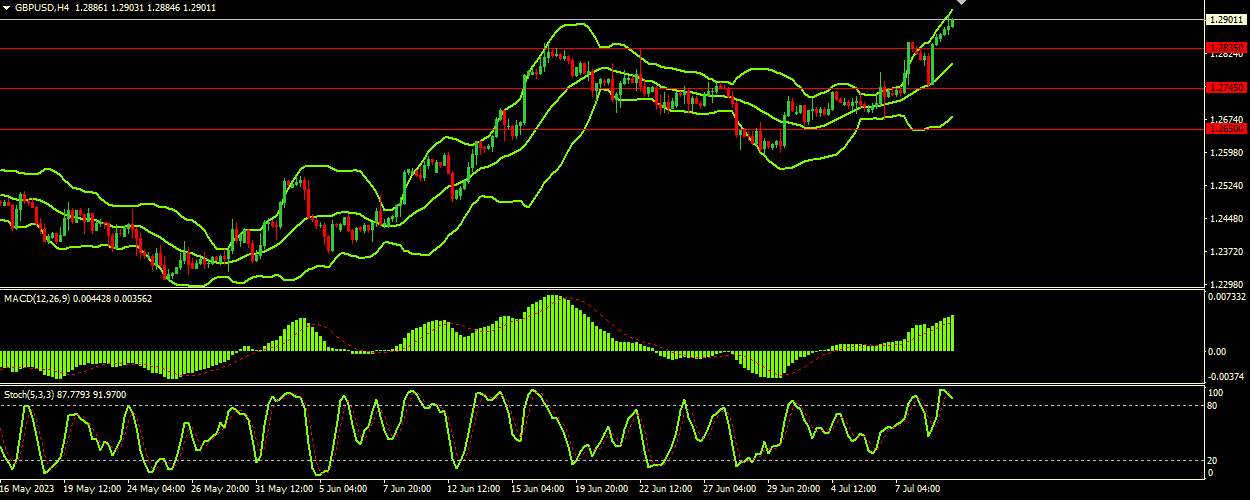

Based on the current position of GBP/USD at 1.28950, the currency pair is approaching the nearest resistance level of 1.29500. The Stochastic oscillator value at 56.5103 signals a bullish trend as it is above the 50 level, but not yet overbought (which usually happens at levels above 80). The Bollinger Bands also confirms the upward direction, with price trading in the upper range of the indicator and above the middle band at 1.27990.

Main scenario (BUY)

Recommended entry level: 1.29500.

Take Profit: 1.30000.

Stop loss: 1.29200.

Alternative scenario (SELL)

Recommended entry level: 1.28350.

Take Profit: 1.27450.

Stop loss: 1.28800.