Fundamental analysis of XAU/USD

Gold prices recovered slightly on Thursday after falling as low as 1924.17 and are trading at 1930.00.

Although the metal remains under selling pressure, it is still struggling with the fallout from the Fed's decisions and comments. At its last September meeting, the Fed kept interest rates at 5.25-5.50% in line with market expectations. Central banks are increasingly expressing confidence in their ability to contain inflation without hurting the economy or causing significant job losses. Fed Chairman Jerome Powell has emphasized the Fed's commitment to the 2% inflation target, signaling that an interest rate hike is possible if deemed necessary. The Fed's latest quarterly outlook said that additional interest rate adjustments are possible this year, which could lead to a change in the benchmark rate to a range of 5.50%-5.75%. The Fed's composite forecast was also revised, stating that the rate could reach 5.1% by the end of 2024, a marked change from the previous forecast of 4.6%. Such an increase in interest rates could have a negative impact on the attractiveness of non-income producing assets such as gold, as they will become relatively more expensive.

A strengthening US dollar coupled with rising two-year Treasury yields further reinforces the bearish outlook for gold. The continued high level of interest rates and lower expectations for lower interest rates over the next two years are factors pushing gold prices lower. In particular, high interest rates may discourage investment in assets that do not earn interest income in U.S. dollars, such as gold. Analysts emphasize the importance of the $1,900 USD mark; it could serve as an important support level in the near term.

With the release of various economic indicators, including weekly US jobless claims, Philadelphia Fed data, home sales and preliminary PMI for September, traders will be keeping a close eye on these indicators to determine future price movements. In addition, global investors will be keeping a close eye on the Bank of England's next decision, assessing whether it will end the series of interest rate hikes that began in December 2021.

Technical analysis and scenarios:

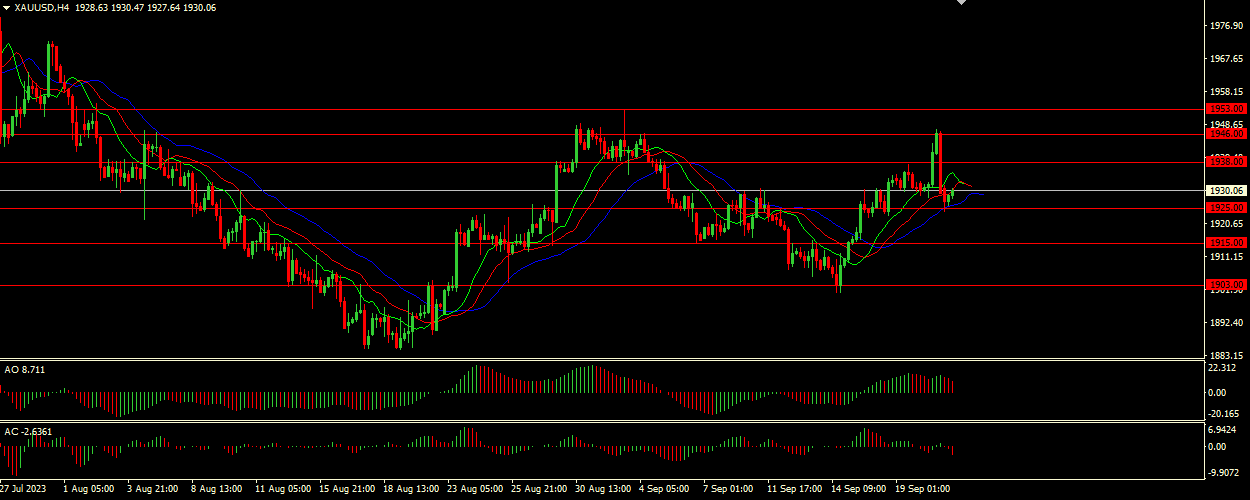

Gold, with a current price of 1930.00, is between several key support and resistance levels. Market indicators are showing mixed sentiment, with Alligator giving bullish signals and Awesome and Accelerator Oscillators giving bearish signals. Taking into account that both Awesome Oscillator (AO) and Accelerator Oscillator (AC) are in the red zone, sell sentiment prevails in the market.

Main Scenario (SELL)

Recommended entry level : 1925.00.

Take Profit: 1915.00.

Stop loss: 1930.00.

Alternative scenario (BUY)

Recommended entry level: 1938.00.

Take Profit: 1946.00.

Stop loss: 1934.00.