Current Dynamics.

White House economic advisor Brian Deese said that a recession in the U.S. is not out of the question. Joe Biden is concerned that there will be no recession. Inflation in Great Britain has reached a record high level for the last 40 years. In October, 40% of Foggy Albion families will not be able to pay their light bills.

Brian Deese, economic adviser to the White House said that the risk of recession is always there, but added that the situation in the U.S. is better than in other major countries. It is worth noting that the Treasury Secretary Janet Yellen and the U.S. Fed Chair Jerome Powell said that there is no risk of recession in the United States. Along with this, at a press conference, U.S. President Joe Biden also said that there will not be a recession in the United States. According to Biden, U.S. GDP will grow rather not decline, and it will grow faster than in China for the first time in 40 years. However, he said that the U.S. is experiencing economic problems, like the rest of the world, but without such consequences as for the rest of the world.

Meanwhile, inflation in Britain reached 9% in April, the highest rate in 40 years. At the same time, the Bank of England expects inflation to peak at 10.25% in the fourth quarter of 2022. It is worth noting that according to several analysts in October 2022, 40% of families in Foggy Albion will not be able to pay for electricity. Currently, 20% of Bhutanese families are already facing this situation. At the same time, the U.K. government is allowing oil and gas extraction off the east coast of Scotland and extending the license for coal mining in South Wales. Thinks that a large number of new oil and gas fields in the North Sea that have a license, but have not yet received final approval, can be implemented without passing the "climate compatibility" tests.

Meanwhile, despite a deal to release oil from the strategic reserves, according to the American Automobile Association gasoline prices in the U.S. set a new record at $4.596 a gallon.

Against this backdrop, the U.K. Chief Secretary to the Treasury said though an emergency tax on energy companies profits has not been passed, it remains "on the table."

From the last speech of Governor of the Bank of England Andrew Bailey, it follows that the Bank of England is looking for support in a strong labor market. But labor force has shrunk by around 1% since the onset of Covid. The BoE's objective is to get inflation back to the target level and avoid so-called second round effects (when rising wages push up inflation).

From all of this it can be concluded that both countries support on a strong labor market, both countries have problems with energy resources, but the U.S. has taken a more hard-line monetary policy. It should be noted that the term "so-called second round effects" starts to appear. The current movement of GBP/USD quotes upward may be considered as the correctional movement.

The UK Composite PMI will be released today at 10:30(GMT+2).

Later in the day at 16:00(GMT+2) there will be data on new home sales in the U.S. for April. Later in the day, Fed Chairman Jerome Powell will give a speech at 18:20(GMT+2).

Support and resistance levels.

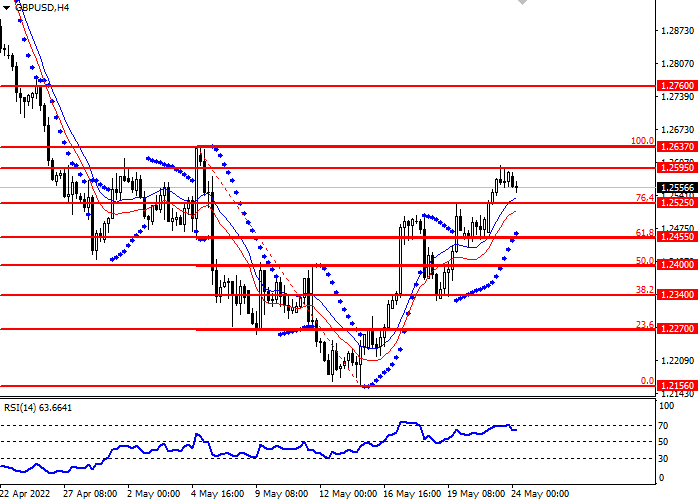

GBP/USD currency pair is consolidating in the zone between the key Fibonacci levels of 76.4 and 100. The RSI oscillator touched the 70 level and moved down.

- Support levels: 1.2525, 1.2455, 1.2400, 1.2340, 1.2270, 1.2156

- Resistance levels: 1.2595, 1.2637, 1.2760

Trading scenarios

- Short positions may be opened from the current level with target 1.2455 and stop-loss 1.2637. Implementation period: 1-3 days

- Long positions may be opened above the level of 1.2637 with target 1.2760 and stop-loss 1.2595 Implementation period: 1-3 days