Current Dynamics

Gasoline prices in the U.S. are setting another record price. The U.S. administration is thinking about using diesel fuel from reserves. The president of Saudi Aramco is warning about a global oil crisis due to low investment. China is increasing its oil imports from Russia.

According to the American Automobile Association, which monitors fuel prices at over 60,000 gasoline stations in the US, the price of gasoline set a new record and has increased to $4.596 per gallon. Prices continue to increase despite the release of oil from strategic reserves as part of a deal with the International Energy Agency. Currently, Washington put up for sale another 40.1 million barrels of oil. In the meantime, the administration of U.S. President D. Biden is thinking of withdrawing additional diesel fuel from reserves in order to hold down prices.

In Brazil, after ignoring the government's demand not to increase prices and increase diesel fuel prices by another 8.9%, J.M. Coelho, president of Petrobras, left his post. It is worth reminding that he stayed in his post only for 40 days.

At the same time for the first time in two years, the Arab Emirates has sent about 1 million barrels of oil to Europe.

Against this background, the president of Saudi Aramco is warning about a global oil crisis due to low investment. Most companies are afraid to invest in the oil and gas sector because of the pressure of the "green agenda". Amin Hassan Nasser noted that Saudi Aramco intends to increase its oil production from 12 to 13 million barrels per day by 2027 but is hardly able to do it faster.

Meanwhile, Saudi Energy Minister Abdulaziz bin Salman Al Saud said Riyadh hopes to "work out an agreement with OPEC+ that includes Russia." The minister said that against the background of uncertainty on the market it is too early to talk about the details of the new agreement, but OPEC+ will increase production if there is demand.

Meanwhile, China has increased its imports of Russian ESPO oil, which is produced in Eastern Siberia.

Gasoline and diesel prices continue to rise despite the best efforts of the countries. The removal of limitations in China due to the COVID-19 could push prices higher.

According to the American Petroleum Institute (API) weekly crude inventories rose 0.567M while experts predicted a 0.690M decline.

Today at 16:30 (GMT+2) the Energy Information Agency (EIA) will release data on crude oil inventories. It is expected a decline of 0.737m in inventories.

Support and resistance levels.

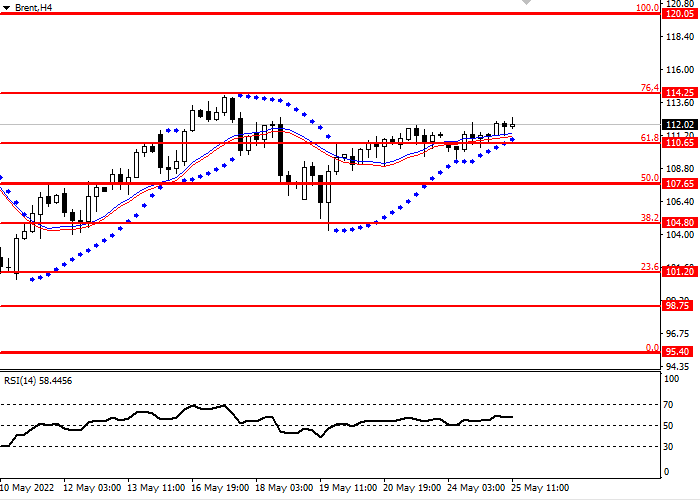

Brent is consolidating near the key Fibonacci level of 68.8. The current trend is upward. The RSI oscillator is above the 50 level.

- Support levels: 110.65,107.65,104.80,101.20, 98.75, 95.40

- Resistance levels: 120.05, 114.25

Trading scenarios

- Long positions can be opened above the level of 114.25, with a target of 120.05 and stop loss of 110.65. Implementation period: 2-4 days

- Short positions can be opened below the level of 110.65, with a target of 107.65 and stop-loss of 112.50. Implementation period: 2-4 days