Current Dynamics.

Bank of Japan Governor Haruhiko Kuroda said at the BOJ-IMES 2022 conference that a global surge in inflation is one of the current challenges for central banks. U.S. Federal Open Market Committee (FOMC) Meeting Minutes had no surprises.

Bank of Japan governor Haruhiko Kuroda said that a global surge in inflation is one of the current problems for central banks. Kuroda also noted that the monetary policy response to inflation will differ between countries, although the common task for each country is to identify the size and stability of inflationary pressures. At the same time, wages increased in Japan, but the growth rate remained moderate, while household pent-up demand was limited and the recovery in aggregate demand was slower than in Europe and the US. Also, from Kuroda's statement, it follows that constraints on supply in Japan may not be as serious as those in the United States.

At the same time, the U.S. Federal Open Market Committee (FOMC) Meeting Minutes notes that further rate increases will be appropriate. However, the Committee expects that inflation will return to its 2% objective and that the labor market will remain strong. Along with that, the committee will be ready to adjust the monetary policy stance if risks arise that could impede the achievement of the Committee's targets.

Meanwhile, Japan Tokyo Core Consumer Price Index (CPI) YoY was lower than 2% and was at 1.9%, while U.S. Initial Jobless Claims data was better than analysts' estimates and was 210K instead of 215K.

Obviously, the U.S. market is strong and Japan's inflation can't stay in the 2% level. It looks like the Fed will increase its key rate by 50bp at the next meeting, while Japan will keep its soft monetary policy, which will lead to further weakening of the yen.

The U.S. Federal Open Market Committee (FOMC) Member Bullard Speaks today at 1:35 pm(GMT +2) and the U.S. Core PCE Price Index will be released a little later at 2:30 pm(GMT +2).

Support and resistance levels.

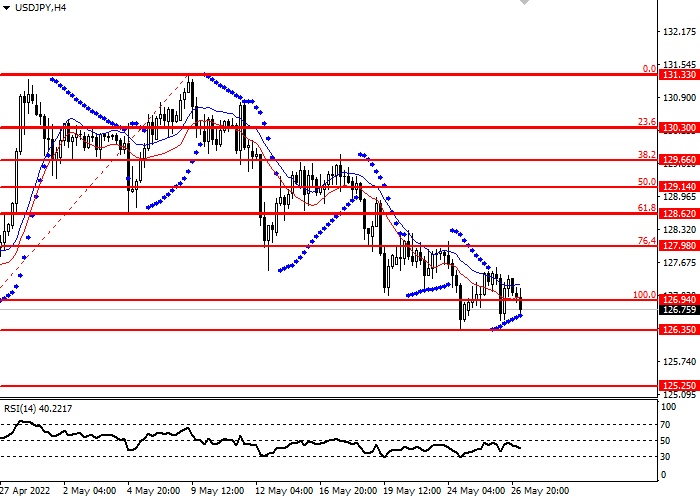

USD/JPY is a little below the key Fibonacci 100 level. The RSI oscillator is below 50.

- Support levels: 126.35, 125.25

- Resistance levels: 131.30, 130.30, 129.66, 129.14, 128.62, 127.98, 126.94

Trading scenarios

- Long positions can be opened at the current level with a target of 127.98 stop loss 126.35: Implementation period: 1-3 days

- Short positions may be opened below the level of 126.35 with target 125.25 stop-loss 126.94: Implementation period: 1-3 days