Current dynamics

GBP/USD is consolidating at 1.26400 amid growing risk appetite.

The market, driven by the "risk-on" impulse pushed the GBP/USD quotes above 1.26500, after which the bulls somewhat cooled their enthusiasm and the pair came to consolidation around the above-mentioned level. With growing appetite for risk, traditional safe havens, in this case the U.S. dollar, are losing investments in favor of higher-yielding currencies.

Thus, the negative macroeconomic data in the USA, expressed in the consumer price index (CPI) of over 8%, high inflation rates and intensifying price pressure, draw a high probability of economic recession, the US dollar index (DXY) continues to be at a monthly minimum. In such circumstances, it is quite difficult to imagine further increase of the FRS key rate in autumn.

The news from the People's Republic of China also played an important role in the growth of risk appetite and the appearance of positive sentiment in the market. On June 1, the main epidemiological restrictions on COVID-19 will be canceled, and together with the end of the lockdown, the world economy will gradually start to grow.

High inflation, rising consumer price index (CPI) in the UK naturally led to another raise of the key rate by the Bank of England (BoE) by 50 bps after the Mays 25 bps.

Among the news expected to affect the price dynamics of GBP/USD pair is the Manufacturing PMI for May, which will be released on June 1 with the expected value of 54.6, the same as the previous value for the UK, and the ADP Non-Farm Employment Change for May with the projected value of 300K versus 247K for the previous period for USA.

Support and resistance levels

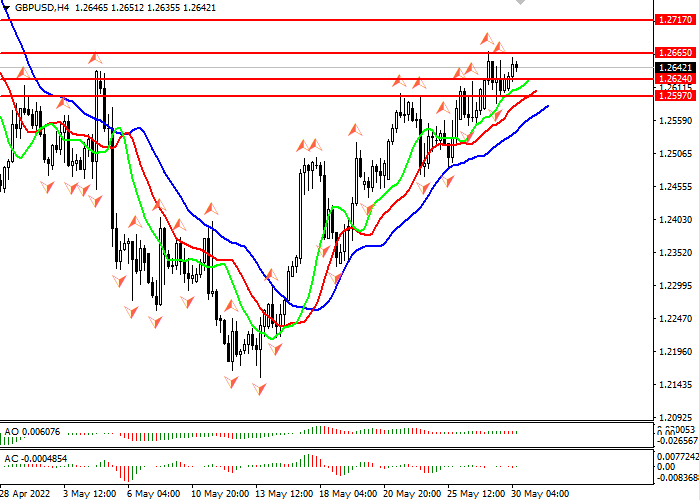

Alligator is hungry: its mouth is wide open, its jaw (blue line) is low under the lips and teeth (green and red lines), the instrument is in an uptrend. The nearest fractal above the alligator’s teeth (red line) is at 1.26650. Awesome Oscillator (AO) and Accelerator Oscillator (AC) are both in the green area, the bars are close to the zero level, which is a strong confirmatory buy signal.

- Support levels: 1.25970, 1.26240

- Resistance levels: 1.26650, 1.27170, 1.27730

Trading scenarios

- Buy stop position may be opened from the level 1.26650 with target 1.27170 and stop-loss 1.2640. Implementation period: 2-3.

- Sell stop position may be opened from the level of 1.26240 with target 1.25970 and stop-loss 1.2640Implementation period: 2-3 days.