Current Dynamics

According to the American Automobile Association, the cost of gasoline on U.S. gas stations reached $4.62 a gallon. For the year the price growth amounted to $1.57 or 51%. It is worth noting the statement of the head of the international energy agency, from which follows that the current energy crisis is much larger than the crises of the 1970s and 1980s.Meanwhile, Petrobras has warned the Brazilian government about the possibility of deficit of diesel fuel on the national market. This may happen due to the discrepancy of internal prices on fuel and oil products with the situation on the world fuel market. It is worth noting that since the beginning of the year Brazil imported fuel and lubricants from the U.S. for $3.7 billion, which is almost 84% more than in 2021. Meanwhile, Brazilian government officials will discuss the possibility of privatizing Petrobras on June 2.

At the same time, EU leaders reached an agreement on a partial ban on Russian oil imports as part of the 6th sanctions package. As part of the agreement, oil is supposed to come to the EU only through one main oil pipeline, which is only 10% of the total volume of oil that the EU buys from Russia. However, the final version of the EU oil embargo against Russia is still unknown. Against this background, with reference on officials from the EU and the United Kingdom statements Financial Times (FT) stated that the UK and the EU have agreed to a ban on insurance of ships with Russian oil. However, it is worth noting that the British government refused to confirm this information to the FT.

Meanwhile, some OPEC members are exploring the idea of suspension of Russia's participation in the oil production deal (OPEC+), as Western sanctions and a partial European ban begin to undermine Moscow's ability to produce more oil, writes The Wall Street Journal, with reference of unnamed OPEC delegates. Releasing Russia from its oil production targets could potentially open the way for Saudi Arabia, the United Arab Emirates (UAE) and other OPEC producers to increase oil production. However, in early May the UAE and Saudi Arabia made it clear that OPEC+ would not be able to increase oil production, as any change would require a unanimous decision. It is worth noting that at the moment OPEC+ is behind the planned level of oil production on 2.6 million barrels per day. At the same time OPEC+ believes that today the oil market is balanced.

Further growth of oil quotes limits fears of the market participants regarding the recovery of demand in China after the softening of the quarantine restrictions, as it is not known how quickly the economic growth will recover and the demand for fuel will recover in the country.

The American Petroleum Institute (API) will release data on weekly U.S. crude oil inventories at 22:30 (GMT+2) today. The Energy Information Agency (EIA) will release data on crude oil inventories tomorrow at 16:30 (GMT+2). It is expected a decline in stocks by 0.067M.

Support and resistance levels.

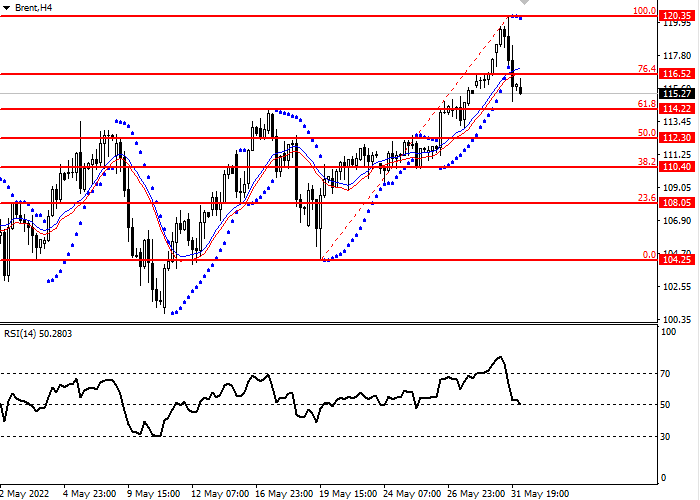

Brent has fallen below the key Fibonacci level of 76.4 and has moved into consolidation. The current trend is upward. The RSI oscillator after crossing the 70 level from top to bottom is near the 50 level at the top.

- Support levels: 114.22, 112.30, 110.40, 108.05, 104.25

- Resistance levels: 120.35, 116.52

Trading scenarios

- Long positions can be opened above the level of 116.52, with a target of 120.35 and a stop loss of 114.22. Implementation period: 2-4 days

- Short positions can be opened below the level of 114.22, with a target of 110.40 and a stop loss of 116.52. Implementation period: 2-4 days