Current Dynamics

The leader of Japan said that the Bank of Japan has kept its position on inflation targets. Japan has adopted a supplementary budget. Japan begins restarting nuclear reactors.Prime Minister Fumio Kishid said in a joint statement of the Bank of Japan and the Japanese government at a meeting of the Budget Committee of the House of Councilors (upper house) of the Parliament that they don't plan to change of their target for inflation rate of 2%. At the same time the Japanese parliament adopted a supplementary budget of 2.7 trillion yen ($21.2 billion) for fighting the sharp rise on fuel and food prices in the current fiscal year. Almost 1.2 trillion yen ($9.4 bln) will be used for prolongation of the current program of oil subsidies till the end of September.

It is worth noting the statement of Japanese Minister of Economy, Trade and Industry Koichi Hagiuda that Japanese government will not leave the Sakhalin-2 project even if they are told to do so. "Sakhalin-2" is an oil and gas project in which Japanese companies Mitsui and Mitsubishi have a 12.5% and 10% stake respectively.

Along with this, at a press conference in Tokyo, the Cabinet Secretary Hirokazu Matsuno announced the restart of reactor No. 2 at Shimane Nuclear Power Plant. It was also said that with the current deficit in energy supply and the continuing growth of fuel prices it is necessary to maximize the use of nuclear energy, based on safety considerations.

Meanwhile in the USA the citizens of Texas risk overpaying for the electric power again, the demand for which reached the maximum levels of May in the history of observation because the citizens try to save from heat with the help of air conditioners. It should be reminded that after the unexpected shutdown of several power plants, prices per megawatt hour in Texas have been raised above $4,000. It is also worth noting that the Atlantic Ocean off the coasts of the U.S. and Mexico begins the storm season, which will end in November.

Increasing prices for energy and energy products will put inflationary pressure on both currencies. However Japan is trying to get inflation up to 2% and the USA is starting to tighten its monetary policy in order to hold inflation rate, which is already above 8%.

Japan Services Purchasing Managers' Index (PMI) for May will be released tomorrow at 02:30 (GMT+2) and is expected to rise to 51.7 points. Later at 14:30 (GMT+2), the U.S. Unemployment Rate for May will be released, expected to decrease to 3.5%.

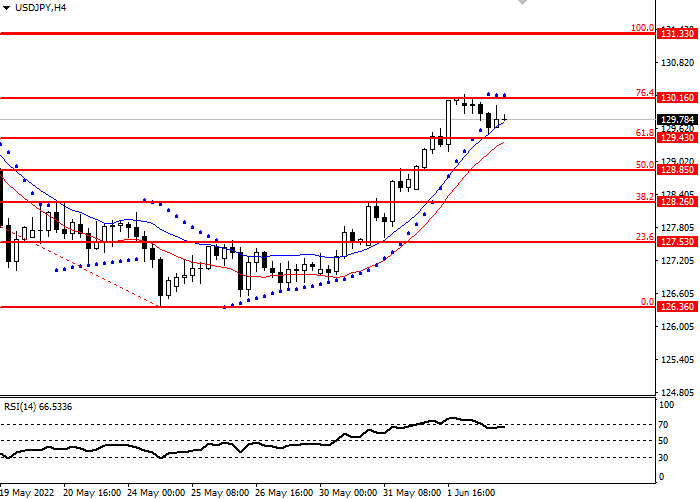

Support and resistance levels.

USD/JPY failed to break through the key level of 76.4 Fibonacci and corrected down, but stayed above the key level of 61.8 Fibonacci. The current trend is upward. The RSI oscillator crossed the 70 level from top to bottom and stayed near the 70 level.

- Support levels: 129.43, 128.85, 128.26, 127.53, 126.36

- Resistance levels: 130.16, 131.33

Trading scenarios

- Long positions can be opened above the level of 130.16, with a target of 131.33 and stop loss 129.43: Implementation period: 2-4 days

- Short positions can be opened below the level of 129.43 with a target of 128.26 and stop loss 130.16: Implementation period: 2-4 days