Current Dynamics

The energy crisis in Australia has led to a six-fold increase in electricity prices in the eastern states. In Australia recommended a 5.1% wage increase. Some experts believe the Reserve Bank of Australia may raise interest rates by 40 bps tomorrow.

The Australian federal government is struggling to find a solution to the country's worsening energy crisis. At the moment, electricity prices for electricity are six times higher than usual price per megawatt hour in the eastern states and reaches $600.

Now the Australian government is exploring the possibility of imposing trade limitations, designed to bring more gas to the local market, but even if the measures are adopted, their effect will only be seen by the end of the year.

Meanwhile, the Australian Labor Minister said the government has decided to recommend a 5.1% wage increase for all "low-wage workers".

Worth noting that wages and spending data convinced ANZ economists to expect a 40bp interest rate hike tomorrow rather than a 25bp hike. While GDP was in line with ANZ forecasts, wage data showed that average hourly non-farm payrolls rose more than 5% in half a year.

The U.S. labor market released last week was better than forecasts. U.S. Nonfarm Payrolls came in at 390,000, better than the forecast of 325,000. The U.S. Unemployment Rate remained the same at 3.6%. Also, the U.S. Hourly Wage Growth in May was 0.3%, which is a bit worse than expected but at the same level as in April.

Thus, strong U.S. data points to the fact that the Fed will not have to correct its plans and slow down the tempo of key rate increase. At the same time even if the RBA decides to increase the rate by 40bp, it is less than 50bp on which the Fed will raise the rate, so the Australian dollar will be under pressure.

Tomorrow at 6:30 (GMT+2) the Australia Interest Rate Decision will be released, forecasting an increase for 25bp to 0.60%. Later that day at 14:30 (GMT+2), U.S. Trade Balance data will be released.

Support and resistance levels.

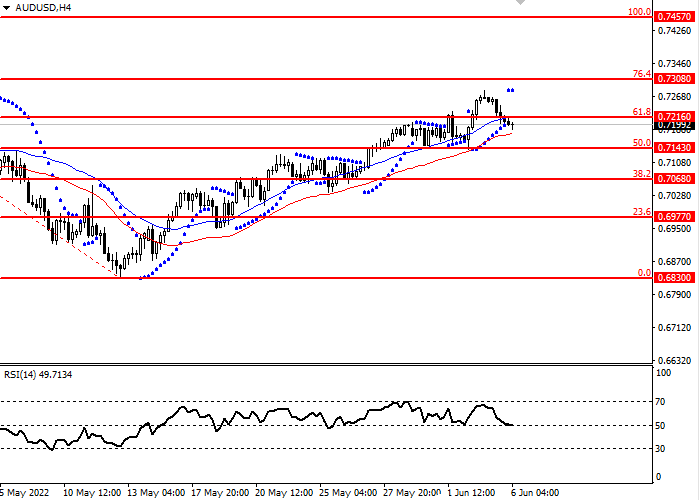

AUD/USD currency pair quotes fell below the key Fibonacci level 61.8. The current trend is going upward. RSI oscillator is near the 50 level in the upper half.

- Support levels: 0.7143, 0.7068, 0.6977, 0.6830

- Resistance levels: 0.7457, 0.7308, 0.7216

Trading scenarios

- Long positions can be opened from the current level with target 0.7308 and stop-loss 0.7143 Implementation period: 1-3 days

- Short positions may be opened below the level of 0.7143 with target 0.6977 and stop-loss 0.7216 Implementation period: 1-3 days