Fundamental analysis of USDJPY

USD/JPY Fundamental Analysis

The USD/JPY currency pair experienced a decline on early Tuesday, triggered by unexpectedly weak US services data. This reinforced expectations of a pause in rate hikes at the Federal Reserve's (Fed) upcoming meeting, but also raised concerns about policy in the coming months.

Concerns about rate volatility.

Recent data and statements from Fed officials about U.S. rates have been the focus of global investor attention, leading to some volatility in the U.S. dollar. After Friday's rally, fueled by a strong U.S. jobs report, the dollar/yen pair retreated due to speculation of a missed rate hike in June. However, weak services sector results again clouded the rate outlook.

The services PMI is causing concern.

Unexpected weakness in the services PMI has raised concerns. According to a survey by the Institute for Supply Management, the U.S. services sector barely expanded in May, with new orders slowing. This led to a three-year low in the indicator of the prices businesses pay for resources, which may support the Fed's efforts to fight inflation.

The dollar is weakening amid the data.

After weak U.S. services sector data on Monday, the dollar weakened slightly against the yen as 10-year Treasury yields fell. The yen usually strengthens when rates are low, as it reduces the yield differential between US and Japanese government bonds. However, the ever-changing situation regarding the final rate and the timing of rate cuts could create problems for potential gains in the USD/JPY pair until more clarity is provided.

Caution ahead of the FOMC meeting.

With no significant U.S. data scheduled for the rest of the week and Fed officials in the black period, it appears that the pair is in a state of waiting ahead of the Federal Open Market Committee (FOMC) meeting. This cautious approach is understandable, as the uncertainty surrounding the policy decision could discourage traders from increasing their positions.

Fluctuating rate expectations.

The Fed's policy dependence on data means that rate expectations could continue to fluctuate significantly given their high sensitivity to incoming economic data. Traders should pay attention to next week's release of the U.S. Consumer Price Index (CPI) report for May, as it will provide additional clues about inflationary pressures and the Fed's possible course of action.

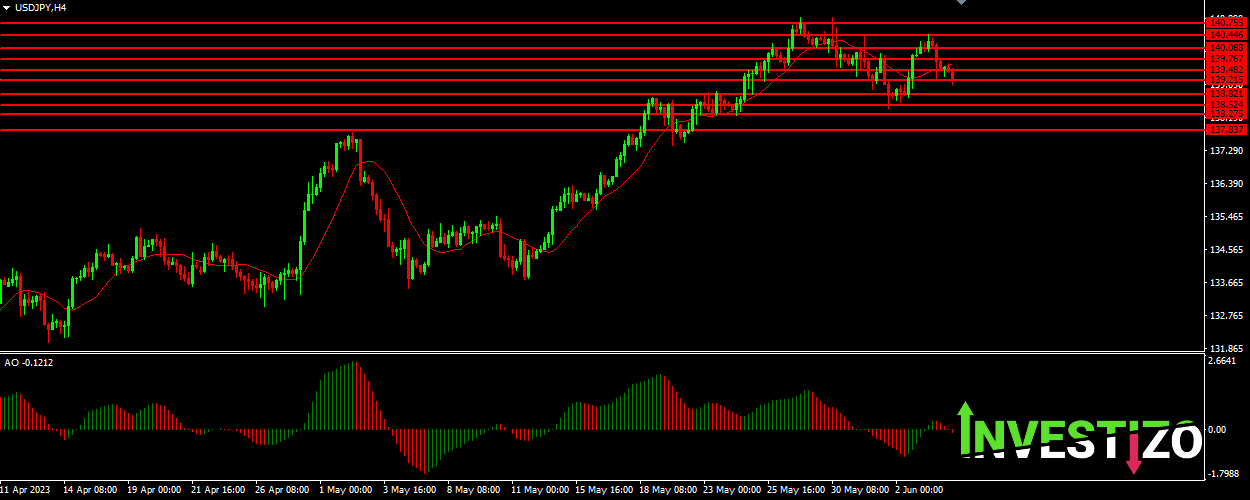

Key levels. Trading Scenarios.

Support levels: 138.275, 1138.525, 138.820, 139.215.

Resistance levels: 139.480, 139.770, 140.090, 140.445, 140.755.

Main scenario:

If the pair USD/JPY is able to hold above the support level of 139.215, it may indicate the continuation of the uptrend. In this case, the resistance level of 139.480 may become a target for buying. If this level is overcome, the next targets will be the levels of 139.770 and 140.090. The recommended stop loss level in this scenario is 138.820.

Alternative scenario (buy):

If the USD/JPY pair drops to the support level 138.820 and bounces off it, this could be a good buying opportunity. The target for take profit in this case can be the level of 139.215, and then 139.480. The stop loss level in this case can be set at 138.525.

Alternative scenario (sell):

If the pair USD/JPY breaks through the support level 139.215 and continues downward movement, it may be a signal to sell. The level of 138.820, and then 138.525 can become a take profit target in this case. The stop loss level in this case can be set at 139.480.