Fundamental analysis of WTI

WTI crude oil prices rose on geopolitical tensions and production decisions and are around 89.90.

A significant catalyst was Russia's decision to halt fuel exports, which led to increased concerns about a possible reduction in global oil supply. This sentiment has been exacerbated by OPEC+'s stance on maintaining production cuts and reports that US crude inventories, particularly at Cushing, are at their lowest level since July 2022.

While WTI and Brent crude futures are showing slight gains, they are on track for a slight weekly decline after actively rising 10% over the past three weeks. There is an opposing sentiment in the market. On the one hand, there are concerns about supply cuts due to decisions by major producers such as Russia and Saudi Arabia, and on the other hand, there are concerns about a possible drop in demand due to monetary tightening in regions such as the US and Europe.

The US Federal Reserve's latest statement showed that it intends to keep interest rates unchanged but take a more hawkish approach, forecasting rates in the 5.50-5.75% range by the end of the year. Such moves, combined with a strengthening US dollar, could make oil more expensive for those trading in other currencies. At the same time, central banks such as the Bank of England and the European Central Bank have announced their intention to keep interest rates unchanged, while the Norwegian bank took the unique route of raising its prime rate.

In addition, market indicators such as the U.S. Dollar Index (DXY) trading around 105.50 and the U.S. 10-year bond yield at 4.50% highlight the complex dynamics affecting oil prices. The latest data on the US economy brought mixed signals: the number of jobless claims fell to the lowest level since January, while the Philadelphia Fed's index of business activity in the manufacturing sector showed a decline.

Against this background, market experts forecast a "bullish" short-term outlook for oil prices, which may approach the 100.00 mark in the coming months. This is due to a supply cut of 1.3 million barrels per day from Saudi Arabia and Russia, which could exacerbate the expected global deficit of 2 million barrels per day.

In light of these multifaceted factors, traders and investors are advised to remain vigilant, especially with respect to OPEC+ actions and changes in global monetary policy. Monitoring critical economic indicators, such as the upcoming US PMI, can provide valuable information for those navigating the complex oil market.

Technical analysis and scenarios:

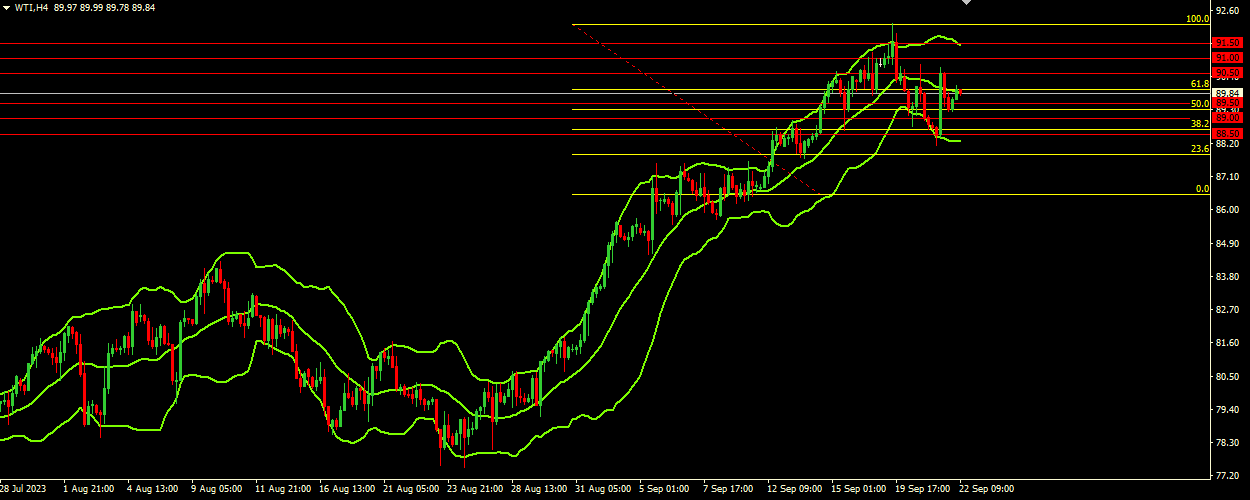

WTI quotes are trading at 89.90, which is very close to the middle Bollinger band located at 89.85. Given the proximity, this band is currently acting as a key pivot point for the asset. The narrowing of the Bollinger Band range indicates that volatility is declining. As the indicator is pointing downwards and the price is currently in the upper range but moving towards the middle, there is consolidation in the market. If the WTI price continues its correction to the middle band and then breaks it, we may see a move towards the lower Bollinger band.

Main scenario (SELL)

Recommended entry level : 89.50.

Take Profit: 89.00.

Stop Loss: 89.75.

Alternative scenario (BUY)

Recommended entry level: 90.50.

Take Profit: 91.00.

Stop loss: 90.25.