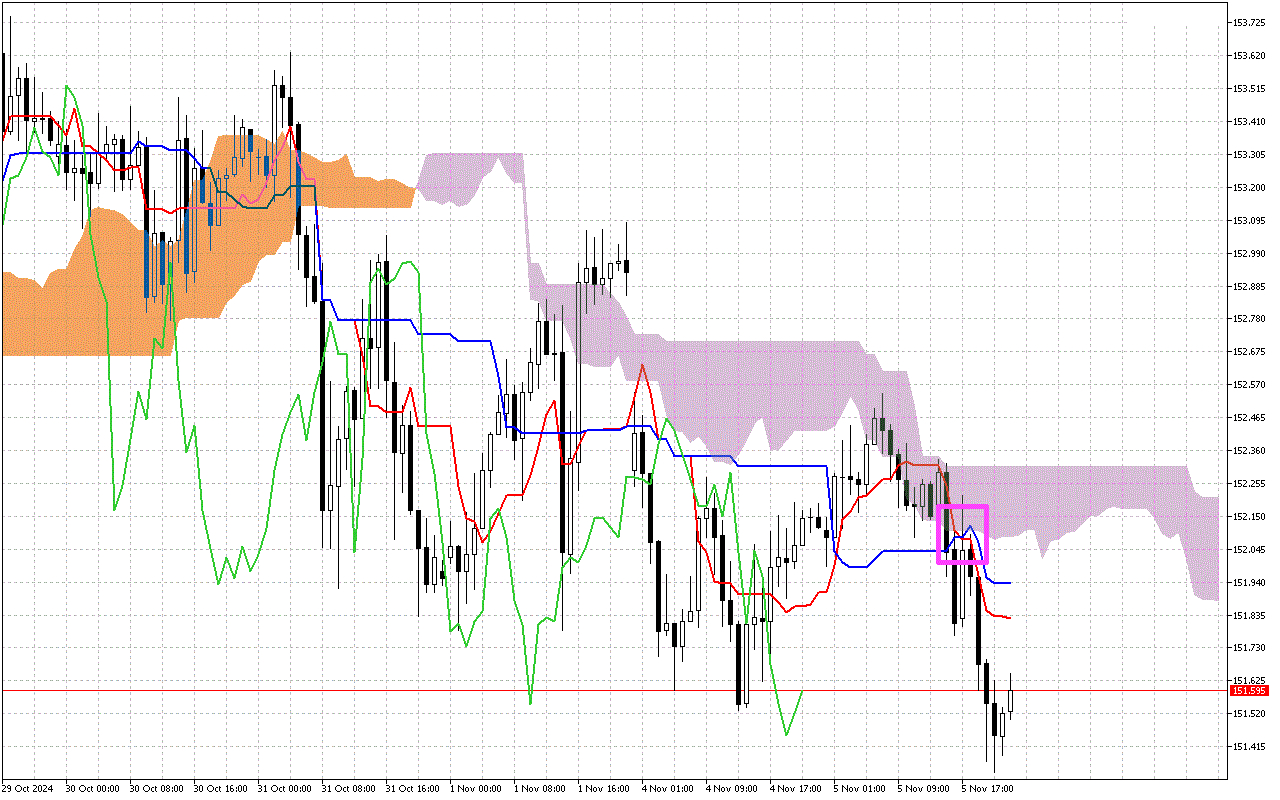

USDJPY H1: The Ichimoku Forecast for the Asian Session on 6.11.2024

The current situation:

Let's look at the main components of the indicator and their current values:

A signal of three lines is being observed on the USDJPY chart. The price is below the red Tenkan line, the blue Kijun line, and the Kumo cloud. This signal indicates further development of the downward movement.

The Kumo cloud is colored lilac. It indicates the priority of the downward vector of price movement.

The price is below the Kumo cloud, which is now acting as a resistance area for the price.

The Chinkou line is now below the current price.

Trading recommendations:

Dynamic resistance levels are on the Tenkan line, in the area of the 151.831, the Kijun line, near the 151.936, the SenkouA line, at the level of 152.086, and the SenkouB line, around 152.310.

Considering all the signals of the Ichimoku indicator, intraday it is worth prioritizing the signals for entering short positions when the price rolls back to resistance levels.