USDCAD H1: The Chaos Theory Forecast for the American Session on 8.11.2024

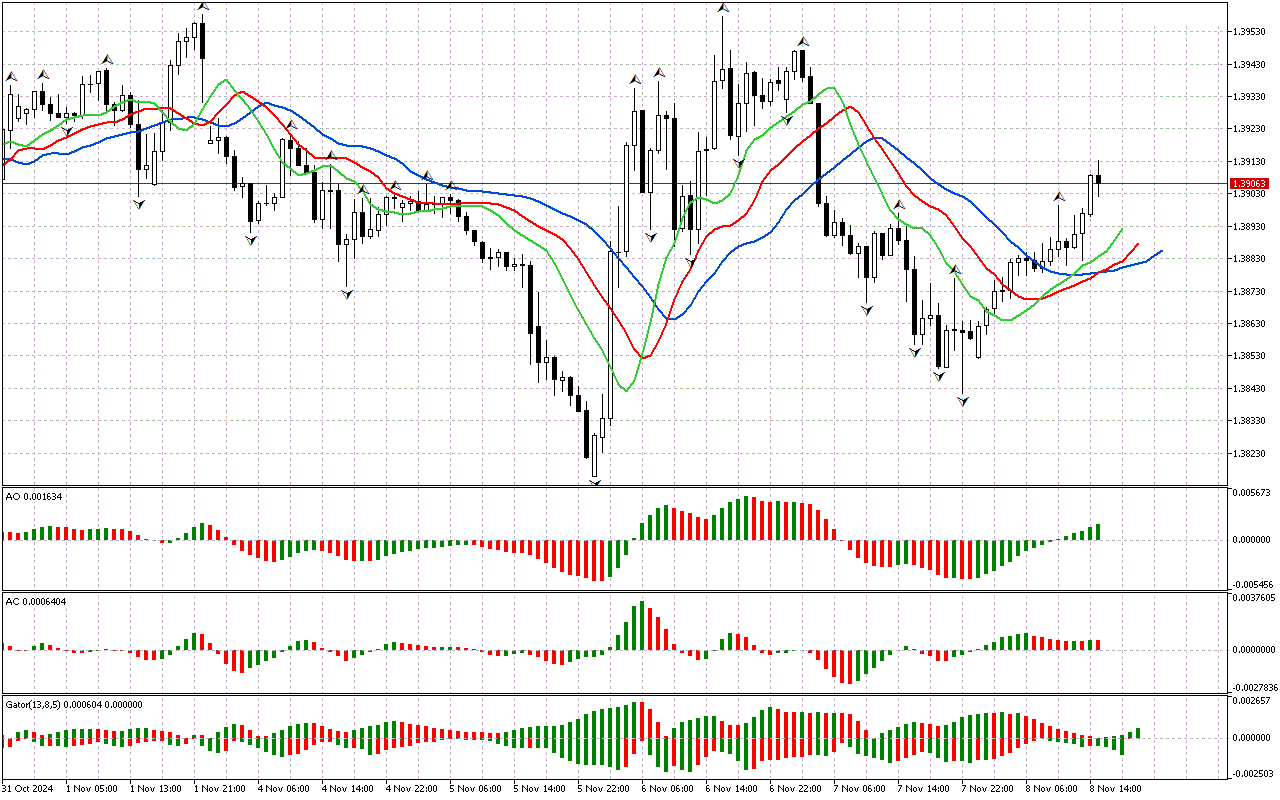

The phase space is defined as northern, but the Alligator's lines are intertwined, which signals a high degree of uncertainty in the market because the Alligator is sleeping. However, the signal from the first phase of the market remains relevant.

The AO indicator is still above the zero mark.

As it is seen, the AC and AO indicators are in the green zone, which indicates that there is enough strength and energy to continue the movement in the northern direction.

The histogram of the Gator indicator has not formed a clear signal yet. The color of the histograms changes, indicating a change in market phase.

Let's summarize. The phase space is defined as northern. The same direction of movement is predominantly proved by other indicators. Against this background, intraday it is worth considering the long positions.

📊 Buy Stop 1.39133

❌ Stop Loss 1.38752

After entering the market, Stop Loss is carried along the red line after the closing of each candle. The profit is fixed by moving Stop Loss, or when opposite signals appear on the AO, AC, Gator indicators.