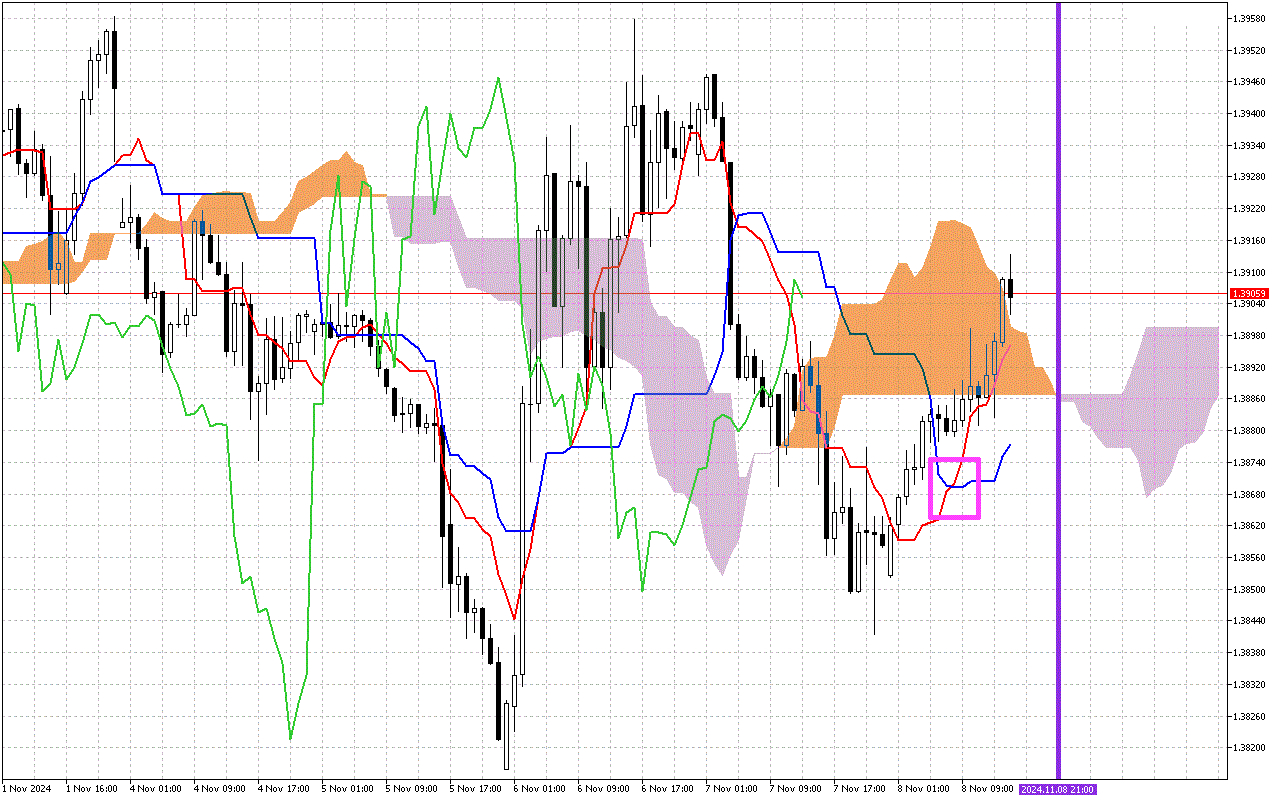

USDCAD H1: The Ichimoku Forecast for the American Session on 8.11.2024

The second most important signal is the change in direction of the Kumo cloud, marked with a vertical purple line. A change in the color of the cloud to lilac indicates a transition of the priority direction of movement to downward.

The current situation:

Let's look at the main components of the indicator and their current values:

The price is above the Tenkan and the Kijun lines. It indicates positive market sentiment.

The Kumo cloud is colored lilac. It indicates the priority of the downward vector of price movement.

In addition, the price is above the Kumo cloud, which acts as a potential support zone.

Used by investors to identify a change in trend, the green Chinkou line is above the price on the chart.

Trading recommendations:

Dynamic support levels are on the Tenkan line, around the 1.38934 mark, the Kijun line, around the 1.38752 mark, the SenkouA line, at the 1.39069mark, and the SenkouB line, around the 1.38868 mark.