USDCAD H1: The Chaos Theory Forecast for the American Session on 22.11.2024

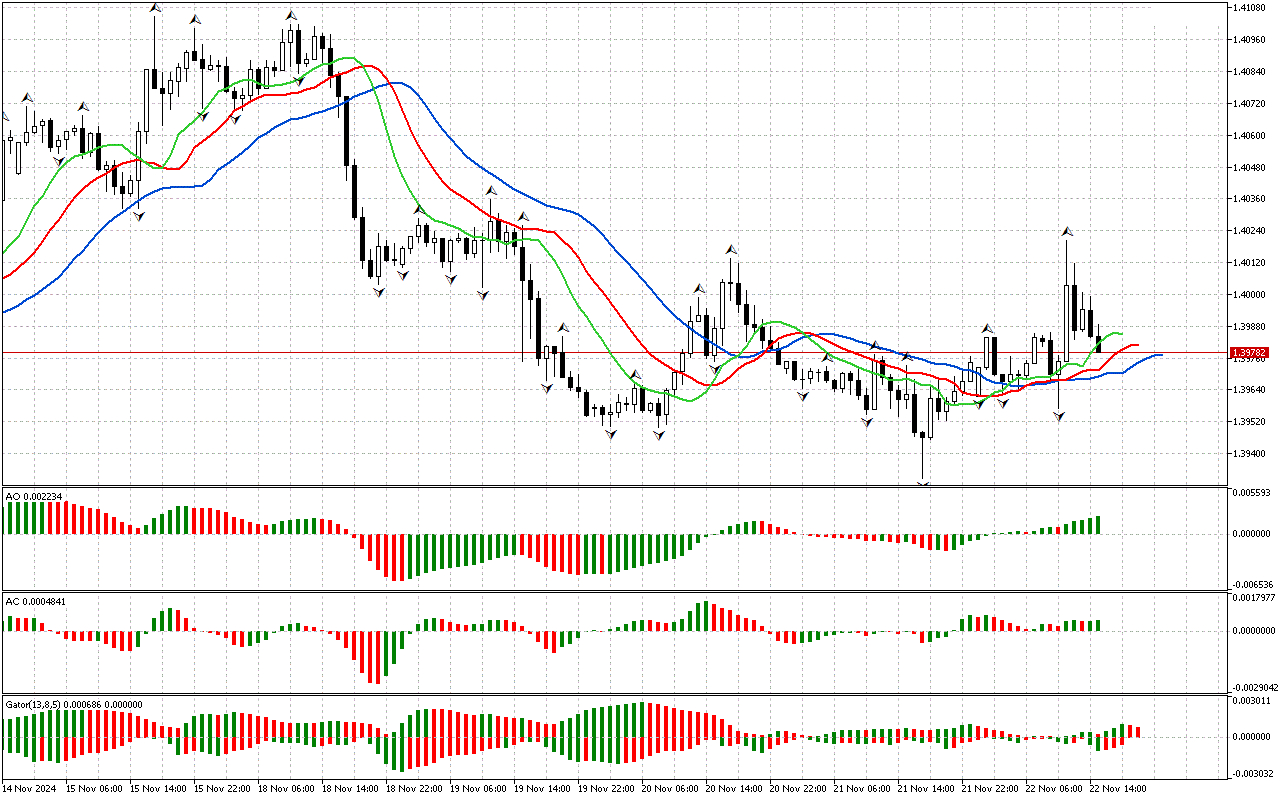

The Alligator indicator confirms the positive market sentiment. The Alligator's mouth is open. It's hungry. Against this background, the price may continue to rise.

The AO indicator is still above the zero mark.

As it is seen, the AC and AO indicators are in the green zone, which indicates that there is enough strength and energy to continue the movement in the northern direction.

The histogram of the Gator indicator has not formed a clear signal yet. The color of the histograms changes, indicating a change in market phase.

Let's summarize. The phase space is defined as northern. The same direction of movement is predominantly proved by other indicators. Against this background, intraday it is worth considering the long positions.

📊 Buy Stop 1.40203

❌ Stop Loss 1.39696

After entering the market, Stop Loss is carried along the red line after the closing of each candle. The profit is fixed by moving Stop Loss, or when opposite signals appear on the AO, AC, Gator indicators.