Fundamental analysis of EUR/USD

The EUR/USD pair is trading in a tight price range around 1.06580 mark

The pair is significantly influenced by the recent actions of the European Central Bank (ECB). After the ECB decided to raise the key interest rate to a record high of 4% on September 14, attention is now focused on the macroeconomic situation. Market participants are eagerly awaiting the manufacturing and services PMIs for France, Germany and the entire eurozone. While the manufacturing PMI is expected to rise slightly, the eurozone services sector is expected to contract more sharply, which is important as this sector accounts for more than 60% of the region's GDP. The fear is that a slowdown in this sector could bring the eurozone closer to a prolonged recession, exacerbated by high interest rates hampering consumer spending. Important data from the ECB was also released. ECB Chief Economist Philip Lane, who recently said that inflation above 2% would hurt the economy, and ECB Governing Council member Luis de Guindos are expected to speak. Any significant deviation in their forecasts from the current high interest rate sentiment could put pressure on

EUR/USD's upward momentum.

On the other side of the Atlantic, the US Federal Reserve decided to keep interest rates at 5.25-5.50%. However, there is widespread speculation that interest rates could be raised later this year. This tightening of monetary policy is consistent with the recent decline in initial jobless claims in the U.S. and other data indicating that the economy is doing well. However, market participants remain cautious as a better-than-expected services PMI could force the Fed to block rate cuts until 2025. The US services sector, which accounts for more than 70% of GDP, will play an important role in this story.

As the Eurozone and the US prepare to release their respective PMI readings, traders remain wary, realizing that the short-term direction of EUR/USD could be determined by its performance. Current market indicators point to a favorable monetary policy and economic trajectory for the US Dollar, but an unexpected decline in the US Services Business Activity Index could be a turning point.

Technical analysis and scenarios:

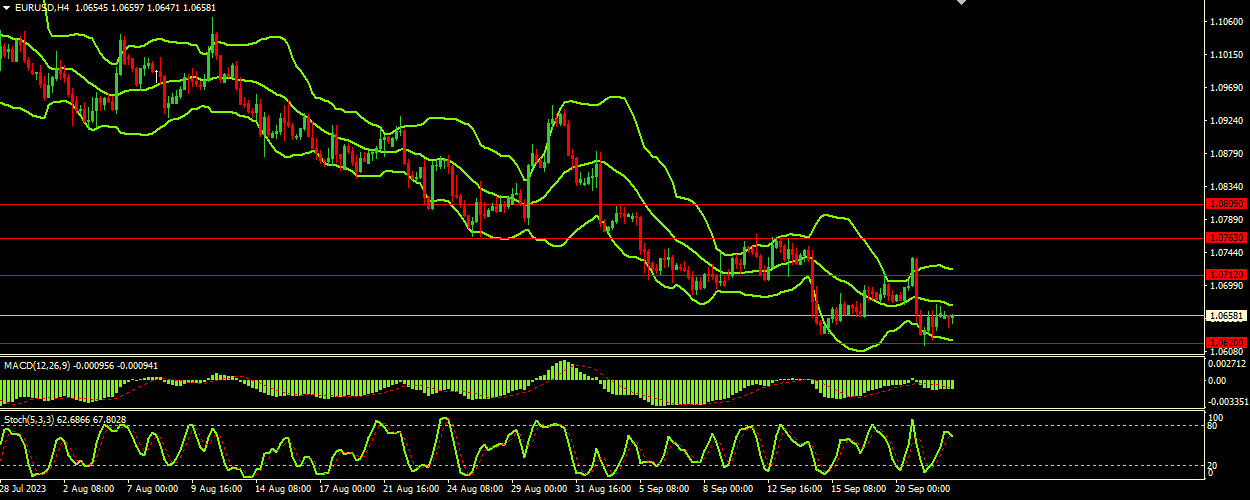

As the current price is closer to the lower band (1/06240) and moving in an extended range, it suggests that the pair is experiencing increased volatility. The price is also below the middle band (1/06720), indicating possible bearish sentiment in the short term. The horizontal direction of the bands may indicate a period of consolidation. The Stochastic oscillator is currently at 62.7612, which is below its signal level of 67.8277. This could be an early sign that momentum is slowing down and the pair may face some resistance. The MACD line and the signal line are quite close to each other, indicating that there is no clear momentum. The negative value indicates a bearish trend, but the small difference between the value and the signal indicates that the trend is not very strong. Given the proximity of the price to the lower Bollinger Band and the negative MACD value, the primary scenario predicts the continuation of the bearish trend.

Primary scenario (SELL)

Recommended entry level: 1.06200.

Take Profit: 1.05700.

Stop Loss: 1.06400.

Alternative scenario (BUY)

Recommended entry level: 1.07120.

Take Profit: 1.07630.

Stop loss: 1.06850.