Fundamental analysis of XAU/USD

During the Asian session, gold prices rose after a recent decline and traded at 1966.70.

The strengthening of the dollar and rising US Treasury yields contributed to the growth of gold sales. The US Dollar Index has recovered from a low of 104.0 and is now near 104.4, while the 10-year US Treasury yield is at 4.5%. The latest US economic indicators paint a mixed picture. The number of new claims for unemployment benefits in the US and the speech of the Federal Reserve representative will also have an impact on the dynamics of gold prices. The producer price index in October decreased by 0.5% quarter-on-quarter, while in September it increased by 0.4%, which was below market expectations. The producer price index for the full year fell to 1.3% from 2.2%. Retail sales also fell 0.1% in October, missing expectations of 0.3%. This data fueled speculation that the Fed may begin cutting interest rates in mid-2024 and that there will be no rate hike in December or January.

In addition, strong economic data from China may support gold prices. China, which is the world's largest producer and consumer of gold, is paying close attention to the October house price index.

Investors are being cautious and cautious, reducing expectations of a rate hike and considering a rate cut next year. Changing economic conditions are affecting the appeal of gold, which is known as a hedge against inflation. While the prospect of continued high interest rates reduces the attractiveness of gold as a long-term investment, the potential for lower rates and signs of slowing inflation could strengthen gold's position. Despite the challenges posed by continued high interest rates, current economic indicators and market expectations point to a very positive outlook for gold.

Technical Analysis and Scenarios:

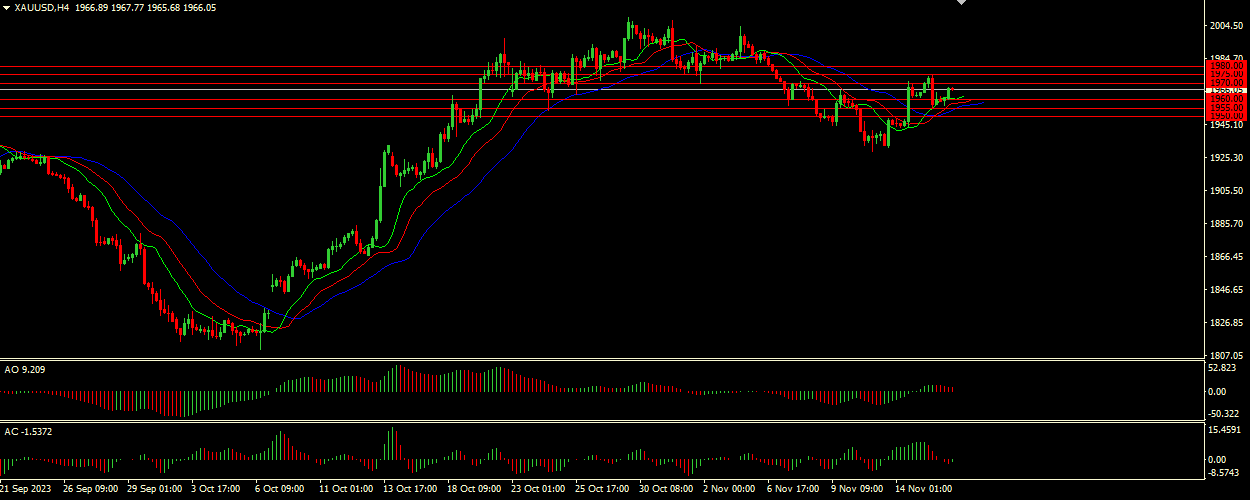

The Alligator indicator indicates a budding uptrend as its jaw (blue line) dips below the lips and teeth (green and red lines). This indicates the presence of bullish momentum in the short term. The Awesome Oscillator (AO) and Accelerator Oscillator (AC), which are in the green zone, are reinforcing the buy signal. This combination suggests that the upward momentum is gaining strength.

Main scenario (BUY)

Recommended entry level: 1970.00

Take Profit: 1975.00

Stop Loss: 1968.50

Alternative scenario (SELL)

Recommended entry level: 1960.00

Take Profit: 1955.00

Stop loss: 1962.50