Fundamental analysis Gold for 23.04.2024

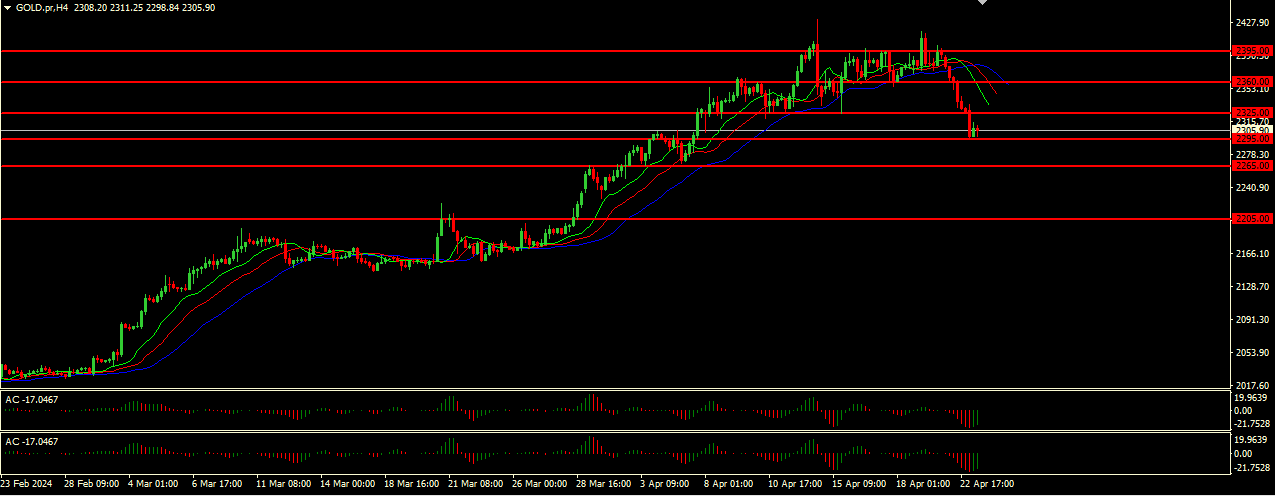

Gold prices for XAU/USD continued their downward slide on Tuesday, echoing the trend from the day prior. Currently hovering near $2,305.90 per ounce, this marks a notable retreat from April's highs around $2,430 per ounce, signaling a notable relaxation in market tensions.

The easing of geopolitical strains between Iran and Israel has played a significant role in this decline, as Tehran's apparent reluctance to retaliate swiftly against Israeli actions has alleviated immediate fears of escalation. Consequently, the risk premium traditionally associated with gold during periods of geopolitical uncertainty has diminished.

Today's economic calendar is marked by several key U.S. releases that could shape the trajectory of XAU/USD:

Flash Manufacturing PMI, expected to inch up to 52.0 from 51.9.

Flash Services PMI, also anticipated to rise to 52.0 from 51.7.

New Home Sales data, forecasted to climb from 662K to 668K, offering further insights into the economic landscape.

These data points will provide valuable cues for the broader economic outlook, influencing Federal Reserve policy decisions and, consequently, shaping the forecast for XAU/USD.

The alligator's mouth is wide open, with the jaw (blue line) above the lips and teeth (green and red lines), indicating a downtrend. This suggests that bearish momentum is strong. Awesome Oscillator (AO) and Accelerator Oscillator (AC) are in the green zone , indicating divergence. This divergence indicates that the current trend is losing strength, but does not provide a clear direction for further price movement.

Main scenario (SELL)

Recommended entry level: 2295.00.

Take profit: 2265.00.

Stop loss: 2325.00.

Alternative scenario (BUY)

Recommended entry level: 2325.00.

Take profit: 2360.00.

Stop loss: 2295.00.