Fundamental analysis of XAU/USD

The gold market is currently in a challenging environment due to economic indicators and central bank policies, leading to a cautious but optimistic outlook for the XAU/USD pair. In early trading on Thursday, gold traded mixed, with the XAU/USD pair trading at 2028. This cautious trading is explained by the wait-and-see attitude of investors, especially ahead of important US non-farm employment news. One of the biggest influences on the gold market is the slowdown in the US labor market, which indicates a decline in the number of jobs and slow growth of wages in the private sector. These trends are raising expectations of a soon-to-be interest rate cut by the Federal Reserve, which has a positive impact on gold prices. Earlier this week, gold prices reached a record high but then fell amid uncertainty about the risk, timing and extent of an interest rate cut.

In addition, benchmark 10-year Treasury yields fell to their lowest level in three months, driven by labor market data and expectations of Federal Reserve policy changes. The difference between 10-year Treasury yields and 2-year Treasury yields indicates a challenging economic outlook and has a direct impact on gold price movements. Despite these trends, gold prices remain range-bound and difficult to influence significantly, driven in part by expectations of a peak in global interest rates and optimistic statements from central banks, including the European Central Bank, the Reserve Bank of Australia and the Bank of Canada.

These factors, along with a slowing U.S. labor market, have supported gold as a safe haven asset. However, as the dollar rose to its highest level in two weeks, gold's gains have been limited. Investors are also looking forward to the non-farm payrolls report, a key part of the Federal Reserve's near-term policy outlook, as well as strong dollar demand and gold price momentum. Weekly US jobless claims released in the North American session on Thursday will provide short-term trading opportunities, but the backdrop remains too favorable for bulls and opportunities for gold to present a significant decline in gold prices.

Technical Analysis and Scenarios:

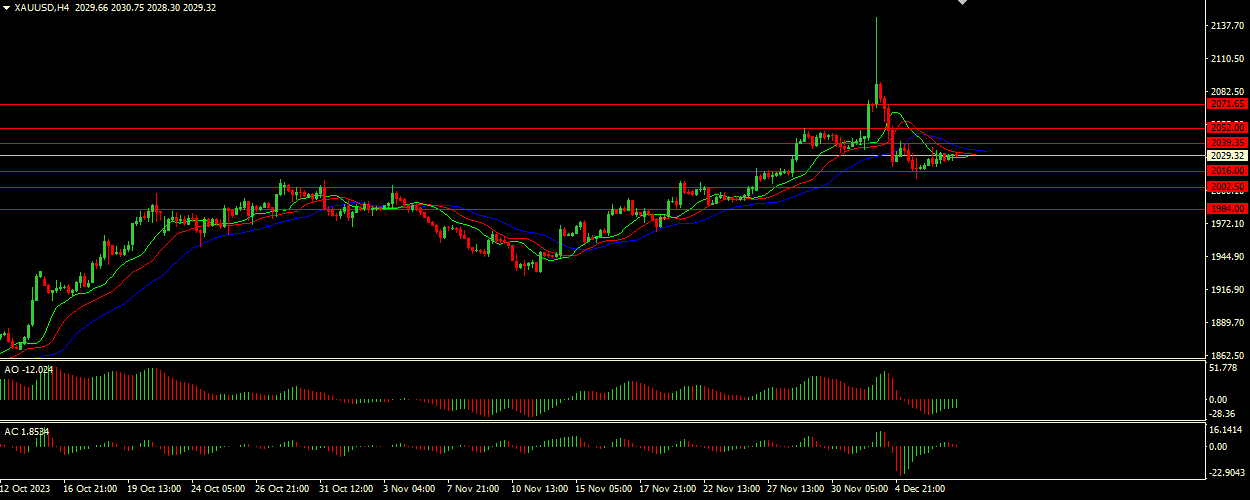

Given the current flat market shown by the Alligator and the divergence shown by the AO and AC, the market may not have a strong directional trend. The main scenario leans towards a slight bullish bias, capitalizing minor upside moves, while alternative scenarios provide options in case of unexpected price moves either to support or resistance levels. It is very important to keep an eye on global economic developments and market news, as these can have a significant impact on gold prices and may require adjustments to your trading strategy.

Main scenario (BUY)

Recommended entry level: 2039.35.

Take Profit: 2052.00.

Stop loss: 2035.00.

Alternative scenario (SELL)

Recommended entry level: 2016.00.

Take profit: 2002.50.

Stop loss: 2020.00.