Fundamental analysis of XAU/USD

Gold (XAU/USD) showed a decline on Monday, falling to the level of 1922.00 as various economic, political and financial developments in the United States contributed to a deterioration in investor sentiment.

The US Federal Reserve hinted at the possibility of an interest rate hike, while a key report on consumer inflation - the personal consumption expenditure price index - is expected to be released. In addition, political uncertainty, especially related to the possibility of a U.S. government shutdown due to disagreements over the budget for the next fiscal year, is causing fluctuations in the market. The tangible threat of a government shutdown at the end of the month, unless a lasting agreement is reached, would have significant economic implications. Similar sentiment is reflected in the gold market, where quotes for the SPDR Gold Trust, the world's first gold-backed ETF, have hit their lowest since January 2020, indicating waning investment enthusiasm. Domestic issues in the U.S., such as the ongoing automaker strike, combined with international factors such as ultra-low interest rates supported by the Bank of Japan and the economic slowdown in Europe are shaping gold price dynamics.

The attractiveness of gold as a non-income producing asset is declining as interest rates rise. The US Dollar Index is trying to consolidate its upward momentum, hovering around 105.70. At the same time, the yield on 10-year U.S. Treasuries rose to 4.45%, showing a correlation between bond yields and rising gold prices. Susan Collins, President of the Boston Fed, and Michelle Michele Bowman, a member of the Federal Reserve Board of Governors, hinted at the possibility of additional interest rate hikes to control inflation. Such measures are consistent with the Fed's intention to keep interest rates high to guide inflation toward the 2% target. Current market forecasts call for another rate hike of at least 25 basis points later this year. The Fed's revised dot plot assumes just two rate cuts in 2024, a significant departure from the previous four projections. In the short term, gold's trajectory is dependent on a combination of political uncertainty and impending interest rate hikes, suggesting a bearish outlook.

While fundamental and technical signals suggest a wait-and-see stance, the market remains attentive to important announcements, be it the PCE report, information on automaker strikes and the outcome of the US government's budget review. The upcoming US economic calendar, which includes data such as Consumer Confidence, Durable Goods Orders and Initial Jobless Claims, as well as Core PCE, will certainly play a crucial role in the future direction of gold prices.

Technical Analysis and Scenarios:

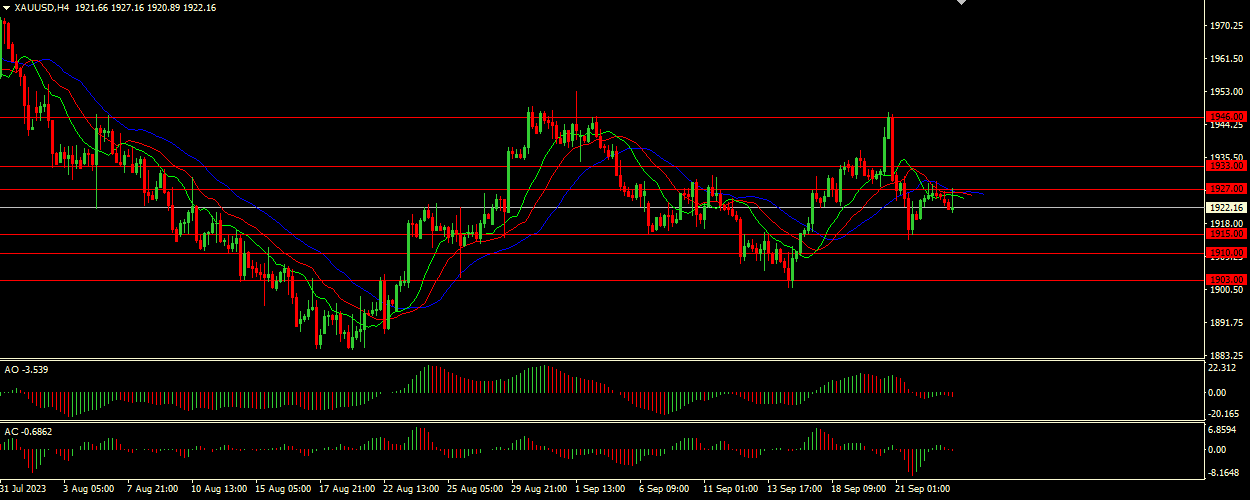

The Alligator is currently in a dormant phase, indicating that there is no clear trend in the market at the moment. The intertwined moving averages further indicate that the instrument is going through a period of consolidation or flat movement. Both the Awesome Oscillator (AO) and Accelerator Oscillator (AC) are near the zero level, but in the red zone. This is usually interpreted as a potential sell signal, especially if both oscillators confirm the same sentiment.

Main scenario (SELL)

Recommended entry level : 1915.00.

Take Profit: 1910.00.

Stop loss: 1917.50.

Alternative scenario (BUY)

Recommended entry level: 1927.00.

Take Profit: 1933.00.

Stop loss: 1925.00.