Fundamental analysis of EURUSD

Macroeconomic News Brief:

U.S.: Stock markets are rising, led by solid gains in U.S. stocks, as markets cheer the passage of a government debt limit bill that averted a catastrophic U.S. default. The debt negotiations in Washington have been a key focus for markets in recent weeks, and the passage of legislation that increases the national debt limit has brought relief.

Eurozone: Eurozone inflation came in below expectations in May. The overall inflation rate fell to an annual rate of 6.1% in May from 7.0% in April, below analysts' forecast of 6.4%. Core inflation fell to 5.3% in May from 5.6% in April.

Macroeconomic Statistics Impact:

German manufacturing orders (m/m) (Apr): The actual figure was better than forecast, which may provide support for the euro as it indicates improved economic activity in Germany, the eurozone's leading economy.

Retail Sales (MoM) (Apr): The figure is yet to be released but if it beat the forecast it might support the EUR as retail sales are an important indicator of consumer demand and economic activity.

EIA Short-Term Energy Outlook: The report will have an impact on the dollar as it affects oil prices which in turn can have an impact on inflation and the Fed's monetary policy.

Weekly Crude Oil Inventories as reported by the American Petroleum Institute (API): If crude oil inventories increase more than expected, it could put pressure on oil prices and therefore weaken the dollar.

Technical Analysis and Scenarios:

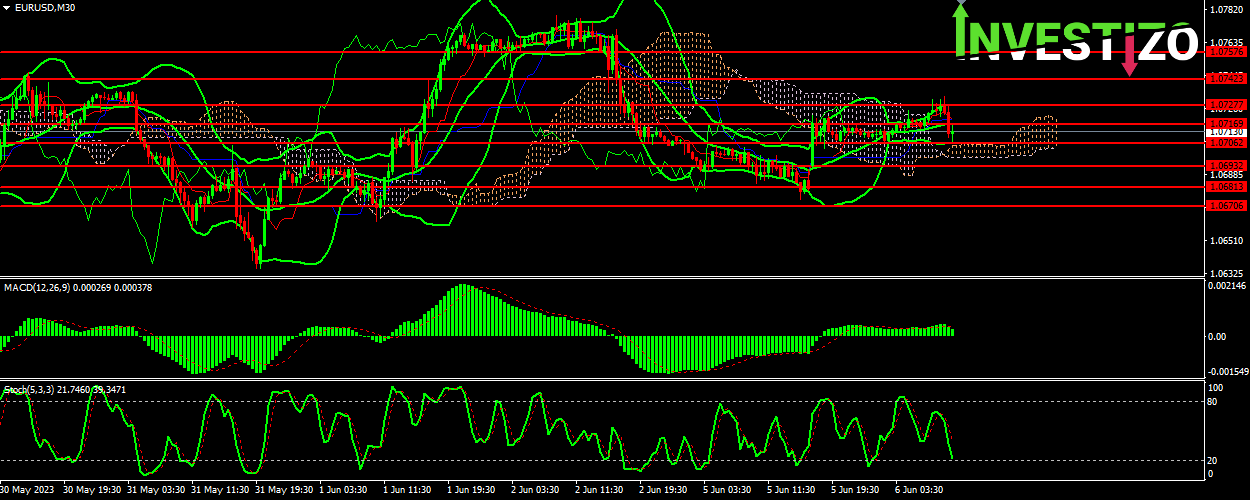

Stochastic Oscillator (5,3,3): The value of 21.7460 indicates oversold, which could signal a possible uptrend reversal in the near future.

Bollinger Bands: The price is in the lower range of the Bollinger Bands, which may also indicate oversold. The bands are widening, which indicates increasing volatility.

MACD (12.26.9): The MACD value is below the signal line, which may indicate a downtrend. However the difference between the MACD and the signal line is not significant, which can indicate a possible weakening of the downtrend.

Based on this data, we can assume that the EUR/USD currency pair may experience downward pressure in the short term. However, the oversold Stochastic Oscillator and Bollinger Bands could signal a possible trend reversal.

Main scenario: buy if the price rebounds from the lower Bollinger Band and the Stochastic Oscillator confirms a reversal. The take profit target can be set at resistance level 1.07170 and stop loss - below support level 1.06700.

Alternative scenario: Sell if the price breaks through the lower Bollinger band and the Stochastic Oscillator remains in the oversold zone. The take profit target can be set at the support level 1.06700, and the stop loss - above the resistance level 1.07170.