Current trends.

Wages in Australia are rising at a record pace since 2018. However, against the backdrop of record inflation in the country, real wage growth is declining. The country's unemployment rate is unchanged, but the share of the economically active population has declined.

The published Australia Wage Price Index YoY was 2.4% while experts forecasted growth of 2.5%. Despite this, this wage growth rate is the highest since 2018. However, the country's inflation rate is also at a record high of 5.1%. This means that real wages in the country decreased by 2.7%.

At the same time, published Minutes of the Monetary Policy Meeting of the Reserve Bank Board noted that the rise in core inflation will be driven by significant increases in fuel and new home prices, while real wages will not keep up with inflation.

Meanwhile, the Organisation for Economic Co-operation and Development showed that third of Australians over 65 years old are at risk of falling below the poverty line. Despite this example, the Australian Minister announced a new policy on the housing market, which will allow Australians to withdraw up to 40% or $50,000 of their pension contributions to purchase a home. However, the decision may lead to an acceleration in house prices, which will speed up inflation.

The unemployment data released today came in a little worse than analysts had predicted. Even though unemployment rate stayed at 3.9% the level of economically active population decreased to 66.3%.

The data on increase of wages and unemployment rate may not allow the RBA to act aggressively and raise the interest rate on 40 bps. With USA plans to increase interest rates by at least 50bp in the next few meetings, it may be concluded that the AUD will remain under pressure in the longer term. However, in China Shanghai cancelled a total lockdown, which may provide support to the Aussie in the short term.

Published data on Australian Unemployment Rate amounted to 3.9% as experts forecast.

U.S. Initial Jobless Claims data will be tiled today at 14:30(GMT+2). Later the same day at 16:00(GMT+2) the U.S. secondary housing market sales data for April will be released; experts expect the index to reach 5.65M.

Support and resistance levels.

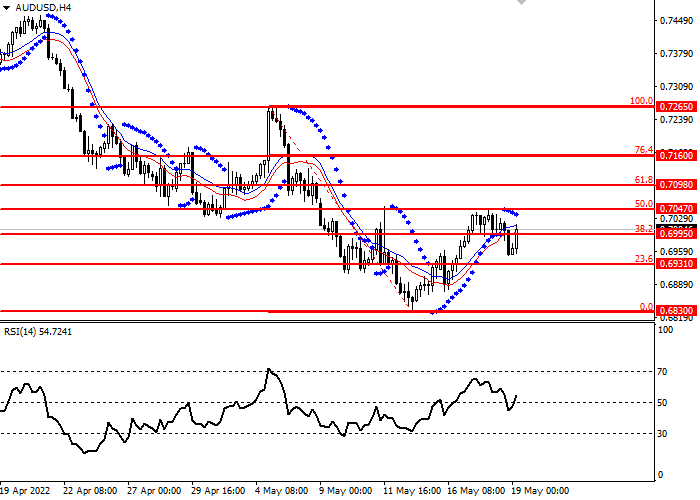

AUD/USD currency pair quotes fell below the key Fibonacci level of 38.2. RSI oscillator crossed the 50 level from the bottom to the top.

- Support levels: 0.6931, 0.6830.

- Resistance levels: 0.7265, 0.7160, 0.7040, 0.6995

Trading scenarios

- Long positions can be opened from the current level with a target of 0.7098 and a stop loss of 0.6931 Implementation period: 1-3 days

- Short positions can be opened below the level of 0.6931 with target 0.6830 and stop-loss 0.6995 Implementation period: 1-3 days