Current dynamics

AUD/USD has been trading flat since the beginning of the week, consolidating near 0.7200.

Against the background of the Reserve Bank of Australia's (RBA) statements that the key rate hike during the next meeting, scheduled for June 7, is likely to take place, due to the continuing growth of inflation, the "ozzy" began to receive additional attention from investors. At the same time, the U.S. dollar also strengthened its positions. Thus, the positive news for the AUD/USD at the moment did not lead to the rapid growth of the pair only because of the accompanying positive circumstances for the "greenback".

The second positive factor for the strengthening of the Australian dollar, a high-yielding currency, sensitive to the risk sentiment, was the growing appetite for risk due to the easing of the COVID-19 restrictions in the People's Republic of China. The restrictions will be partly loosened on June 1, but yesterday the positive macroeconomic data on the Chinese economy has already come out. The Manufacturing PMI was 49.6 against the expected 48.0 and the Non-Manufacturing PMI was 47.8 against the previous 41.9.

The U.S. inflation rate is gradually declining, nevertheless the pause in tightening of the monetary policy that was discussed so much the previous days in the traders community, most likely, will not take place. Thus, Christopher J. Waller, a member of The Federal Reserve Board of Governors, says he intends to raise the key rate until inflation reaches 2% against the current 6%. Another growth driver for the U.S. national currency is another round of crude oil prices growth, which is a significant export item for the U.S. economy. The above-mentioned factors together with the growth of treasury yields have naturally led to the strengthening of the U.S. dollar.

The U.S. Consumer Confidence Index coming out today, the U.S. Manufacturing PMI and the Australian GDP data coming out tomorrow are among the news that may influence the AUD/USD pair's movement in the near future.

Support and resistance levels

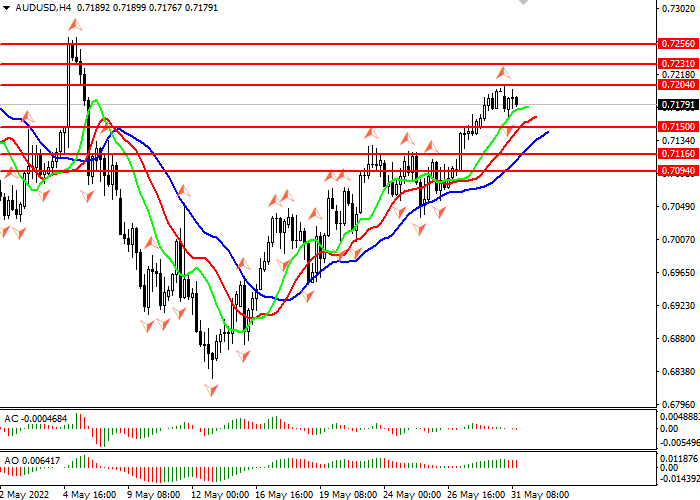

- Support levels: 0.71500, 0.71160, 0.70940.

- Resistance levels: 0.72040, 0.72310, 0.72560.

Trading scenarios

- Sell stop position may be opened from the level 0.71500 with target 0.71160 and stop-loss 0.71500. Implementation period: 1-2days.

- Buy stop position may be opened from the level of 0.72040 with target 0.72310 and stop-loss 0.71500. Implementation period: 1-2 days.