Fundamental analysis Gold for 28.03.2024

Gold, represented by XAU/USD, has maintained its position near the upper threshold of its weekly trading range as it grapples with breaching the psychological barrier of $2,200. The recent commentary from Federal Reserve (Fed) Governor Christopher Waller, expressing reluctance towards immediate rate cuts amidst elevated inflation, has propelled the US Dollar upward, exerting pressure on the non-yielding precious metal. Waller's stance contrasts with earlier Fed projections indicating a more accommodative monetary policy, which has somewhat restrained the bullish momentum of the US Dollar, thereby offering marginal support to gold.

Waller's remarks, although hinting at potential future rate cuts contingent on inflation moderation, have moderated expectations for an imminent policy shift, dampening gold's ascent. Concurrently, the Fed's previous forecast of multiple rate reductions by the year-end, alongside market anticipation of an initial cut in June, underscores the uncertainty surrounding the Fed's monetary trajectory, influencing gold's price action.

In addition to monetary policy dynamics, gold's trajectory is influenced by broader market sentiments. A prevailing cautious tone, driven by geopolitical tensions including the prolonged Russia-Ukraine conflict and unrest in the Middle East, continues to bolster safe-haven demand, cushioning gold against significant downward corrections. Furthermore, traders exhibit a degree of prudence, awaiting further clarity on the Fed's rate-cutting agenda before committing to directional trades, with particular focus on the upcoming release of the US Personal Consumption Expenditures (PCE) Price Index.

Moreover, forthcoming addresses from Fed Chair Jerome Powell and FOMC member Mary Daly are poised to offer further insights into the central bank's policy direction, following a week marked by mixed signals from various Fed officials. These pronouncements are anticipated to steer investor sentiment and, consequently, gold's trajectory in the immediate term.

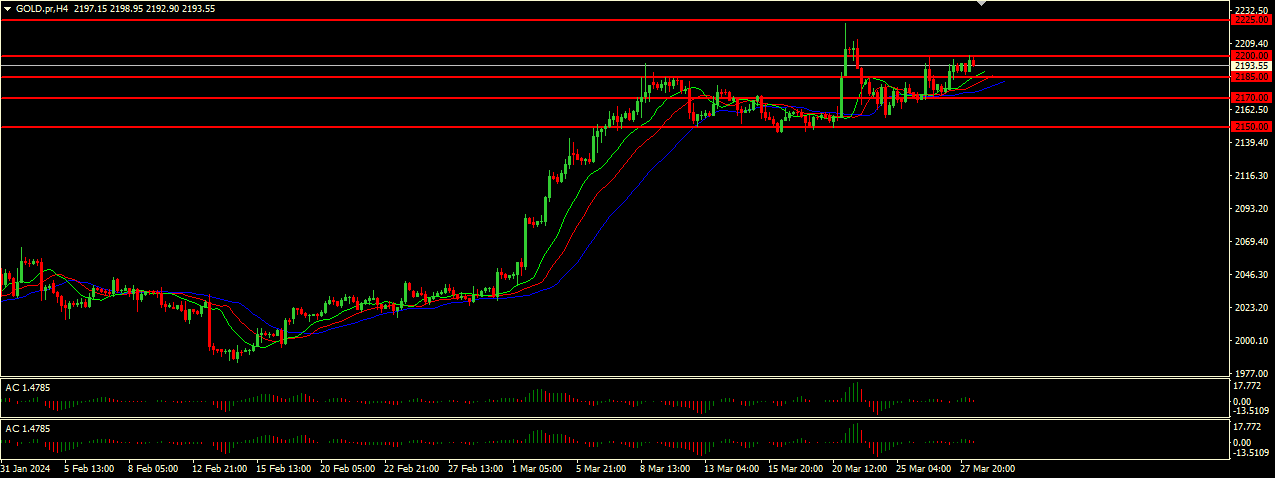

Technical analysis and scenarios:

The Alligator indicator is indicating an uptrend due to its standing state, where the jaw (blue line) is below the lips and teeth (green and red lines). However, this bullish signal is refuted by other indicators. The Brilliant Oscillator (AO) and Accelerating Oscillator (AC) are in the red zone near zero, showing divergence. The lack of clear momentum and divergence suggests that traders should be cautious as there is no strong signal for the direction of the market. Given the current price of 2193.55 and flat indicators, the main scenario suggests that XAU/USD will continue its range movement between the nearest support and resistance levels.

Main scenario (BUY)

Recommended entry level: 2185.00

Take profit: 2200.00

Stop loss: 2170.00

Alternative scenario (SELL)

Recommended entry level: 2170.00

Take profit: 2150.00

Stop loss: 2185.00